What Homeowners Want To Know About Selling in Today’s Market

If you’re thinking about selling your house, you’re likely hearing about the cooling housing market and wondering what that means for you. While it's not the peak intensity we saw during the pandemic, we’re still in a sellers’ market. That means you haven’t missed your window. Realtor.com explains:

Mortgage Rates Will Come Down, It’s Just a Matter of Time

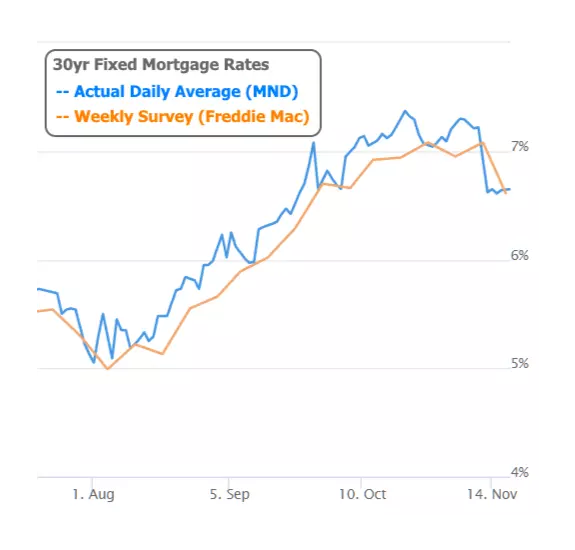

This past year, rising mortgage rates have slowed the red-hot housing market. Over the past nine months, we’ve seen fewer homes sold than the previous month as home price growth has slowed. All of this is due to the fact that the average 30-year fixed mortgage rate has doubled this year, severely li

Fed Says: Don't Get Too Excited About Rates Just Yet

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.63% -0.02% 15YR Fixed 6.05% -0.05% Fed Says: Don't Get Too Excited About Rates Just Yet There's no question that last week was an exciting one for rates. On Wednesday, the average 30yr fixed was fairly close to the

More People Are Finding the Benefits of Multigenerational Households Today

If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational l

Top Questions About Selling Your Home This Winte

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decisio

Construction Costs, Buyer Traffic Continue to Sap Builder Confidence

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.64% +0.03% 15YR Fixed 6.08% +0.03% Construction Costs, Buyer Traffic Continue to Sap Builder Confidence The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) fell another 5 point

Mortgage Rates Roughly Unchanged After Last Week's Huge Drop

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.61% -0.04% 15YR Fixed 6.05% -0.07% Mortgage Rates Roughly Unchanged After Last Week's Huge Drop If you're just getting caught up, last Thursday was one for the record books--at least when it comes to the daily reco

It May Be Time To Add Newly Built Homes to Your Search

If you put a pause on your home search because you weren’t sure where you’d go once you sold your house, it might be a good time to get back into the market. If you’re willing to work with a trusted agent to consider a newly built home, you may have even more options and incentives than you realize.

What’s Ahead for Mortgage Rates and Home Prices?

What’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and

Early Indications Show September Home Prices Falling Less Than July/August

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.21% -0.04% 15YR Fixed 6.55% -0.07% Early Indications Show September Home Prices Falling Less Than July/August Roughly 2 weeks ago, home price indices (HPIs) from Case Shiller and the FHFA came out for the month of

The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view homeownership as a key life achievement. Let’s explore just a few of the reasons why so many Americans continue t

Key Factors Affecting Home Affordability Today

Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s true rates have risen dramatically, it’s important to remember they aren’t the

3 Trends That Are Good News for Today’s Homebuyers

While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home. As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are jus

Millennials Are Still a Driving Force of Today’s Buyer Demand

If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for. While the millennial generation has been dubbed the renter generation, that nam

Fannie, Freddie ordered to slash fees for many first-time homebuyers

Regulators order mortgage giants to eliminate upfront fees on many purchase loans in order to help first-time homebuyers of limited means, the Federal Housing Finance Agency said Monday Fannie Mae and Freddie Mac’s federal regulator is ordering the mortgage giants to eliminate upfront fees on many p

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008 With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place

Home prices cooled at a record pace in August, S&P Case-Shiller says

Summary Home prices are still higher than they were a year ago, but gains are shrinking at the fastest pace on record, according to S&P Case-Shiller. Prices in August were 13% higher nationally compared with August 2021. That is down from a 15.6% annual gain in the previous month. Home prices are st

Mortgage Pre-Approval Is a Critical First Step on Your Homebuying Journey

If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months ago, getting a mortgage pre-approval can be a game changer. Here’s why. What Is Pre-Approval? To be

Should You Still Buy a Home w/ the Latest News About Inflation?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession. You’re likely feeling the impact in your day-to-day life

NJ Housing Market: Perspective Matters When Selling Your House Today

Perspective Matters When Selling Your House Today Does the latest news about the housing market have you questioning your plans to sell your house? If so, perspective is key. Here are some of the ways a trusted real estate professional can explain the shift that’s happening today and why it’s still

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265