Fannie, Freddie ordered to slash fees for many first-time homebuyers

Regulators order mortgage giants to eliminate upfront fees on many purchase loans in order to help first-time homebuyers of limited means, the Federal Housing Finance Agency said Monday

Fannie Mae and Freddie Mac’s federal regulator is ordering the mortgage giants to eliminate upfront fees on many purchase loans to help first-time homebuyers of limited means, and also increase fees for most cash-out refinancings early next year.

The revisions to Fannie and Freddie’s pricing framework — which are expected to benefit about one in five homebuyers taking out loans backed by the government-sponsored enterprises — were announced Monday by Federal Housing Finance Agency Director Sandra Thompson.

In a keynote address at the Mortgage Bankers Association’s annual convention in Nashville, Thompson also detailed major revisions to the procedures lenders will be required to use when evaluating borrowers’ creditworthiness.

Lenders doing business with Fannie and Freddie will be required to provide two credit scores — the FICO 10T and VantageScore 4.0 — which are seen as more inclusive, and will replace the Classic FICO score that’s been in use for nearly two decades.

While Thompson said implementation of the new credit score requirements will be a “multiyear” process, FHFA plans put the new fee reductions in place “as soon as possible.”

In addition, as part of ongoing efforts to address appraisal bias, FHFA has made public data derived from more than 47 million appraisals, Thompson said.

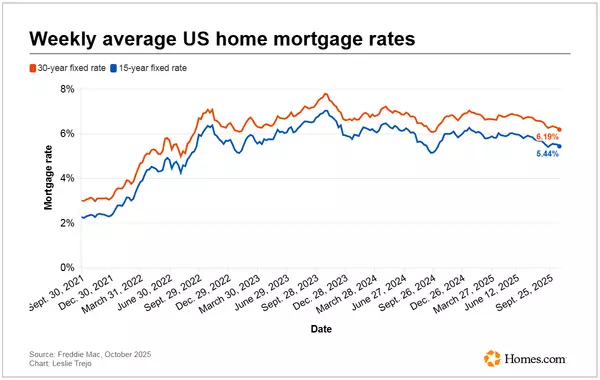

In her address, Thompson made it clear that regulators are acutely aware of the impact that rising mortgage rates and home prices have had on housing markets, and are looking for ways to provide relief without putting Fannie and Freddie at risk.

“As I often say, improving access and fostering safety and soundness are twin pillars of our work. It is not a choice between the two. Instead, they can — and do — complement each other,” Thompson said.

‘Targeted’ pricing changes

Federal regulators have instructed Fannie and Freddie to eliminate upfront fees for first-time homebuyers, low-income borrowers, and underserved communities “to promote sustainable and equitable access to affordable housing,” Thompson said.

Upfront fees are to be eliminated for:

- First-time homebuyers at or below 100 percent of area median income (AMI) in most markets, or below 120 percent of AMI in high-cost areas

- Fannie and Freddie’s affordable mortgage programs, HomeReady and Home Possible, which let homebuyers put as little as 3 percent down

- HFA Preferred and HFA Advantage loans, offered by Fannie and Freddie through state housing finance agencies (HFAs)

- Single-family loans supporting the Duty to Serve program in support of manufactured housing and rural housing

Bob Broeksmit, president and CEO of the Mortgage Bankers Association, welcomed each of the initiatives announced by Thompson. “Given the ongoing affordability challenges facing homebuyers, FHFA’s targeted adjustments to [Fannie and Freddie’s] pricing framework … are well-timed and will improve access to credit for low- and moderate-income households, first-time buyers, and minority buyers,” Broeksmit said in a statement.

Recent Posts