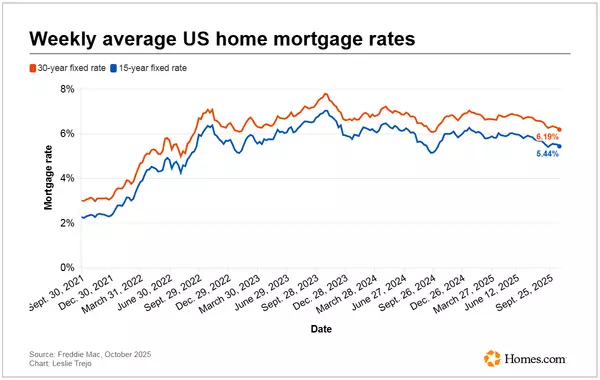

Mortgage rates fall to their lowest average in more than a year

Mortgage rates fall to their lowest average in more than a year

The 30-year, fixed-rate loan hit 6.19% as of Thursday

October 23, 2025

Mortgage rates sank further this week — hitting their lowest average since October 2024.

As of Thursday, the 30-year, fixed-rate mortgage averaged 6.19%, according

U.S. home foreclosure rate rises to five-year high

Foreclosures are rising again. But don't call it 2008. About 188,000 homes landed in foreclosure in the first half of 2025, ticking up 6% from last year to the highest tally since 2019, according to ATTOM.

Illinois and Delaware share the dubious honor of the highest foreclosure rates, while Alas

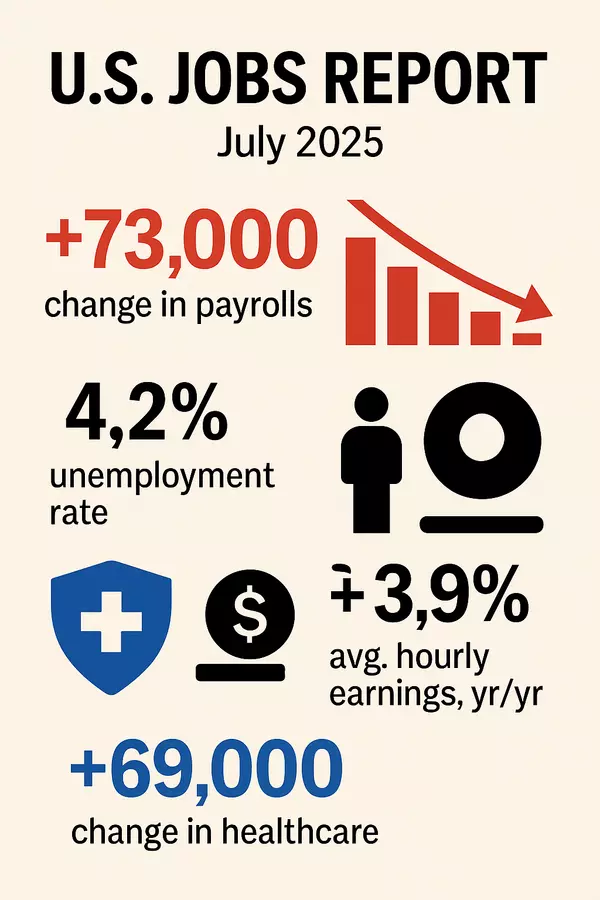

A Summer Surprise: Labor Market Slump in July 2025

A Summer Surprise: Labor Market Slump in July 2025

The U.S. job market took an unexpectedly sharp turn in July. Employers added just 73,000 jobs, far below expectations and a steep drop from revised June and May figures (Investors.com, The Washington Post). At the same time, May and June job totals

Zillow’s Climate Risk Labels Under Scrutiny: When Flood Zones Are Mis Labeled

Zillow’s Climate Risk Labels Under Scrutiny: When Flood Zones Are Mis‑Labeled

🌍 A New Era of Climate Risk Data

In fall 2024, Zillow rolled out a “climate risk threat score” on all U.S. for‑sale listings—spanning flood, wildfire, wind, heat, and air quality categories—based on data from First Stree

July 2025 - Market Trends for Monmouth County, New Jersey

What Buyers (all types of homebuyers including first-time and move-up buyers) Should Know About Today’s Market in Monmouth County, New Jersey

In the dynamic real estate landscape of Monmouth County, New Jersey, understanding the current market trends is crucial for making informed homebuying decisi

Purchase Demand Near 2 Year Highs; Refi's Bounce Back

30YR Fixed

6.89%

+0.04%

15YR Fixed

6.16%

+0.02%

Purchase Demand Near 2 Year Highs; Refis Bounce Back

After a Memorial Day-induced lull, mortgage application activity rebounded sharply last week, according to the Mortgage Bankers A

Mortgage Application Demand Ebbs For Both Purchases and Refi's

30YR Fixed

6.89%

-0.04%

15YR Fixed

6.20%

-0.01%

Application Demand Ebbs For Both Purchases and Refis

The Mortgage Bankers Association’s (MBA) latest survey showed a pullback in mortgage applications, with rates dipping slight

Lowest Mortgage Rates in More Than 5 Months

30YR Fixed

6.63%

-0.12%

15YR Fixed

6.05%

-0.09%

Lowest Mortgage Rates in More Than 5 Months

Yesterday afternoon's tariff announcement sent financial markets on a ride that ultimately resulted in sharply lower stock prices and moderately l

Tariffs could drive up new home prices by as much as $22,000, research finds

On Tuesday, President Donald Trump’s administration imposed new tariffs on imports from Canada and Mexico while increasing existing tariffs on goods from China, a move expected to raise prices for new homes, according to a recent CoreLogic report.

That’s largely because tariffs affect essential hom

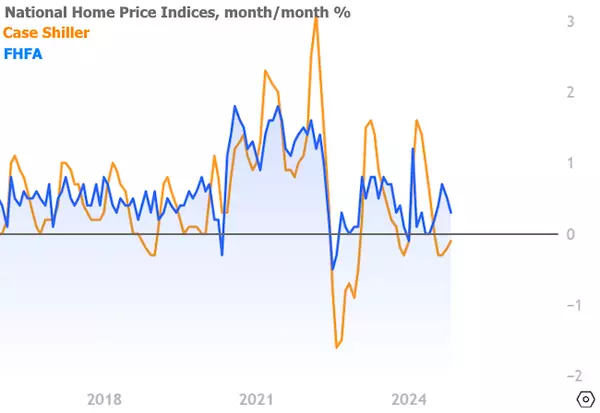

Home Price Appreciation Ran Just Above Expectations in November

Ryan Skove has shared this article with you. View | Download

30YR Fixed

7.07%

+0.00%

15YR Fixed

6.49%

+0.01%

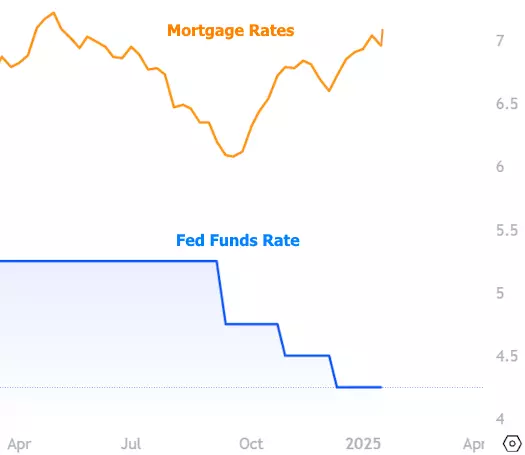

Can Trump Actually Force Rates to Move Lower?

Ryan Skove has shared this article with you. View | Download

30YR Fixed

7.07%

-0.04%

15YR Fixed

6.48%

-0.03%

Existing Home Sales Inch Up to Highest Levels Since February

Ryan Skove has shared this article with you. View | Download

30YR Fixed

7.11%

-0.01%

15YR Fixed

6.51%

-0.01%

What is a Buyer Agency Agreement?

CONSUMER GUIDE:

WHY AM I BEING ASKED TO SIGN A WRITTEN BUYER AGREEMENT?

If you’re a homebuyer working with an agent who is a REALTOR®, it means you are working with a professional ethically obligated to work in your best interest. As of August 17, 2024, you will be asked to sign a written buyer agr

My Commitment to our Clients - Please Read

CONSUMER GUIDE:

REALTORS’® DUTY TO PUT CLIENT INTERESTS ABOVE THEIR OWN

A REALTOR® is a special kind of real estate agent: one who follows NAR’s strict Code of Ethics, including the first and primary pledge to protect and promote the interests of their clients.

This obligation means that a REALTO

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Since the supply of homes for sale is growing and mortgage rates are coming down, you may be thinking it’s finally your moment to jump into the market. To make sure you’re ready, you need to get pre-approved for a mortgage.

That’s

Reasons To Move in Today’s Shifting Market

You have 3 key opportunities if you’re looking to move this fall. Inventory is growing, homebuilders are motivated to sell, and mortgage rates have come down from their recent peak. Let’s connect if you want more information.

Rates Plummet as The Market Buys Into The Big Shift

30YR Fixed

6.40%

-0.22%

15YR Fixed

5.89%

-0.26%

Rates Plummet as The Market Buys Into The Big Shift

The events of this past week serve as an exclamation point in one of the many sentences that tells the story of the big shift

Fed Rate Cuts Remain Elusive.

Why Markets Can’t Count on Inflation Data for Insight and 5 Other Things to Know Today.

Traders are still in the dark about when the Federal Reserve might start cutting interest rates. Even two new inflation data points this week may not provide much more clarity.

The producer price index is out T

Little Change in Mortgage Application Volume, Despite Lower Rates

30YR Fixed

6.91%

+0.00%

15YR Fixed

6.47%

+0.00%

Little Change in Mortgage Application Volume, Despite Lower Rates

The Mortgage Bankers Association said its Market Composite Index moved lower last week, apparently indifferent to a slight im

New Home Sales Decline Slightly, Prices Too

30YR Fixed

6.91%

+0.00%

15YR Fixed

6.47%

+0.00%

New Home Sales Decline Slightly, Prices Too

Sales of newly constructed homes were virtually unchanged in February. The 662,000 seasonally adjusted annual units recorded in during the

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265