July 2025 - Market Trends for Monmouth County, New Jersey

What Buyers (all types of homebuyers including first-time and move-up buyers) Should Know About Today’s Market in Monmouth County, New Jersey

In the dynamic real estate landscape of Monmouth County, New Jersey, understanding the current market trends is crucial for making informed homebuying decisions. Whether you're a first-time homebuyer or looking to upgrade, the following insights will help you navigate the market effectively.

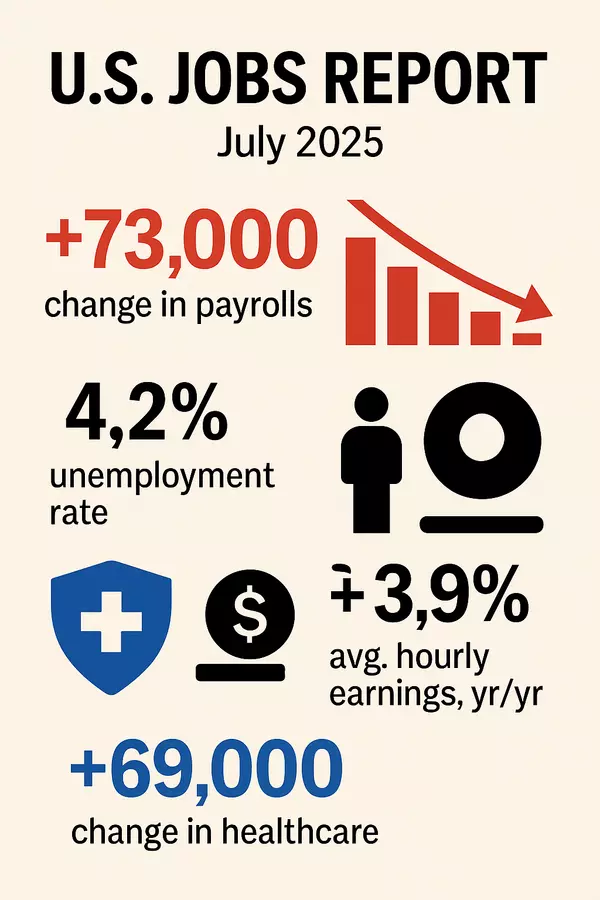

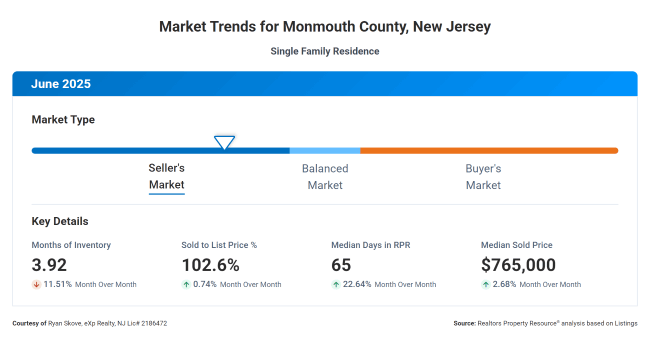

With a months of inventory figure at 3.92, Monmouth County is currently experiencing a seller's market. This means that there are fewer homes available relative to the number of buyers, potentially leading to increased competition and quicker sales. Buyers should be prepared to act swiftly when they find a property that meets their needs, as the limited inventory could lead to multiple offers and less room for negotiation.

The 1-month inventory trend has decreased by 12%, and the 12-month inventory trend has shown a decline of 94%. These downward trends in inventory suggest that the availability of homes has consistently decreased over the past year. For buyers, this indicates a sustained seller's market, where acting decisively and having a clear strategy are more important than ever.

Homes in Monmouth County are selling for about 103% of their asking price. This means that, on average, homes are selling above their listed prices, highlighting the competitive nature of the market. Buyers should be prepared to potentially offer above the asking price to secure their desired property and should factor this into their budgeting and financing plans.

The median days on market for homes is 65, indicating a steady pace of sales. While this is not a fast-paced market, it also doesn't suggest an abundance of time. Buyers should use this time to conduct thorough research and due diligence, but be ready to move quickly once their ideal home is identified.

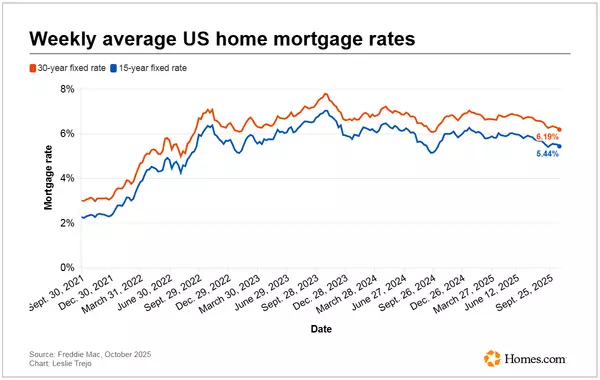

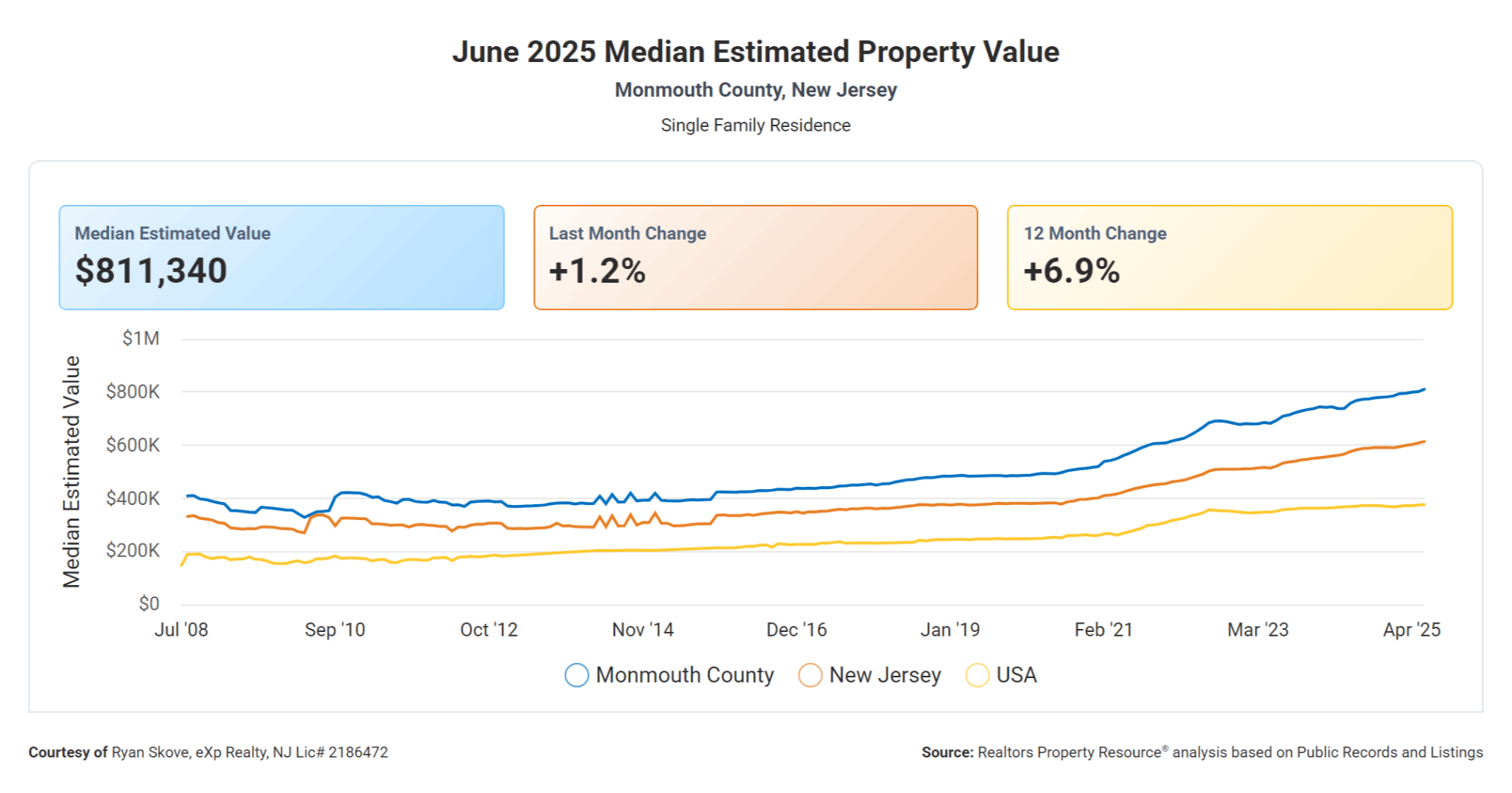

Lastly, the median sold price in Monmouth County is $765,000. This figure provides a benchmark for pricing expectations in the area. Buyers should assess their financial readiness and explore mortgage options to determine affordability and align their home search with their budget.

Understanding these market dynamics can empower you to make informed decisions. For personalized guidance tailored to your specific needs and circumstances, feel free to contact Ryan Skove at eXp Realty.

Recent Posts