Tinton Falls Housing Dynamics: Low Supply, High Speed

Tinton Falls Pricing Trends: What October 2025 Means for Buyers and Sellers The Tinton Falls real estate market continues to be competitive, fast-moving, and shaped by low inventory. For both buyers and sellers, understanding how homes are being priced—and what they are actually selling for—is ess

Little Silver, New Jersey Market Trends – October 2025

Single Family Residence Q: Are prices rising?A: The median sold price in Little Silver is $1,137,500, although there was a 34% decrease in the median sold price compared to last month. Q: How is inventory looking?A: With a 1.28-month supply of inventory, Little Silver is experiencing a tight marke

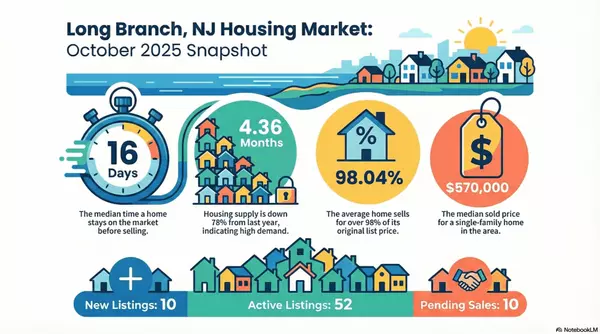

Long Branch, NJ Real Estate Market Trends – October 2025

Navigating the Long Branch, New Jersey, real estate market in October 2025 requires a keen eye on both buying and selling dynamics. With a 4.36-month supply of inventory and a striking 78% drop in inventory over the past year, timing is key for those making simultaneous moves. New listings are sca

Real Estate Market UPDATE: Red Bank, NJ, October 2025

Welcome to the vibrant real estate market of Red Bank, New Jersey, October 2025, where single-family residences are experiencing dynamic trends. For sellers poised to list their homes, understanding the current market landscape is key to making informed decisions. What’s Happening- Supply: The month

Shadow Lake Village Market Trends – October 2025

Shadow Lake Village Market Trends – October 2025 Single Family + Condo/Townhouse/Apt. Caption - Months Supply: 2.89 (MoM 160%; YoY -4%)- Median Sold Price: $470,000 (MoM 24%)- Sold-to-List: 99.45% (MoM -0%)- Median Days: 13 (MoM -59%)- New/Active/Pending Snapshot: 11 new, 13 active, 3 pending Shad

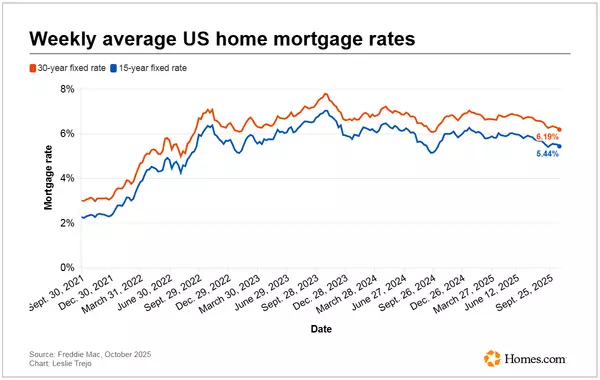

Mortgage rates fall to their lowest average in more than a year

Mortgage rates fall to their lowest average in more than a year The 30-year, fixed-rate loan hit 6.19% as of Thursday October 23, 2025 Mortgage rates sank further this week — hitting their lowest average since October 2024. As of Thursday, the 30-year, fixed-rate mortgage averaged 6.19%, according t

U.S. home foreclosure rate rises to five-year high

Foreclosures are rising again. But don't call it 2008. About 188,000 homes landed in foreclosure in the first half of 2025, ticking up 6% from last year to the highest tally since 2019, according to ATTOM. Illinois and Delaware share the dubious honor of the highest foreclosure rates, while Alask

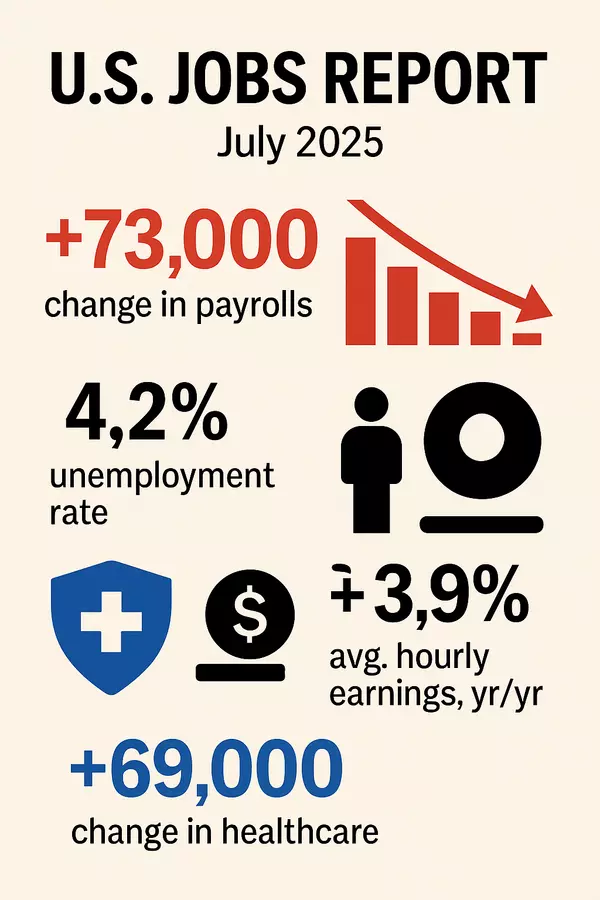

A Summer Surprise: Labor Market Slump in July 2025

A Summer Surprise: Labor Market Slump in July 2025 The U.S. job market took an unexpectedly sharp turn in July. Employers added just 73,000 jobs, far below expectations and a steep drop from revised June and May figures (Investors.com, The Washington Post). At the same time, May and June job totals

Zillow’s Climate Risk Labels Under Scrutiny: When Flood Zones Are Mis Labeled

Zillow’s Climate Risk Labels Under Scrutiny: When Flood Zones Are Mis‑Labeled 🌍 A New Era of Climate Risk Data In fall 2024, Zillow rolled out a “climate risk threat score” on all U.S. for‑sale listings—spanning flood, wildfire, wind, heat, and air quality categories—based on data from First Street

July 2025 - Market Trends for Monmouth County, New Jersey

What Buyers (all types of homebuyers including first-time and move-up buyers) Should Know About Today’s Market in Monmouth County, New Jersey In the dynamic real estate landscape of Monmouth County, New Jersey, understanding the current market trends is crucial for making informed homebuying decisio

Purchase Demand Near 2 Year Highs; Refi's Bounce Back

30YR Fixed 6.89% +0.04% 15YR Fixed 6.16% +0.02% Purchase Demand Near 2 Year Highs; Refis Bounce Back After a Memorial Day-induced lull, mortgage application activity rebounded sharply last week, according to the Mortgage Bankers Association’s (MBA) latest survey. Both purchase and refinance demand

Mortgage Application Demand Ebbs For Both Purchases and Refi's

30YR Fixed 6.89% -0.04% 15YR Fixed 6.20% -0.01% Application Demand Ebbs For Both Purchases and Refis The Mortgage Bankers Association’s (MBA) latest survey showed a pullback in mortgage applications, with rates dipping slightly after a three-week climb. The week’s numbers were also affected by the

Lowest Mortgage Rates in More Than 5 Months

30YR Fixed 6.63% -0.12% 15YR Fixed 6.05% -0.09% Lowest Mortgage Rates in More Than 5 Months Yesterday afternoon's tariff announcement sent financial markets on a ride that ultimately resulted in sharply lower stock prices and moderately lower bond yields. Stocks don't always correlate with bond

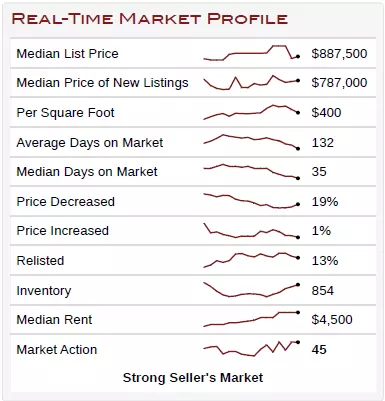

Monmouth County Market Report – April 2025

📍 Monmouth County Market Report – April 2025 If you're following the pulse of Monmouth County real estate, the latest data confirms what local agents already feel on the ground: it’s still a strong seller’s market, but signs of balance are creeping in. Whether you're prepping to sell, looking to bu

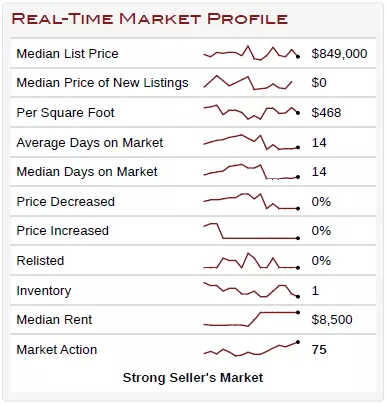

Little Silver Real Estate Market: April 2025

🔥 Little Silver Real Estate Market: April 2025 Snapshot If you’ve been wondering “How’s the market in Little Silver?” — we’ve got the answers, and the numbers are speaking loud and clear: it’s a strong seller’s market. Let’s break down the latest data and what it means for you, whether you're plann

Pending Home Sales Advanced 2.0% in February

NAR forecasts mortgage rates will average 6.4%, existing-home sales will increase by 6%, new-home sales will improve by 10% and the national median home price will rise by 3% in 2025 Key Highlights Pending home sales in February augmented 2.0%. Compared to one month ago, pending home sales declined

Existing-Home Sales Accelerated 4.2% in February

Key Highlights Existing-home sales advanced 4.2% in February to a seasonally adjusted annual rate of 4.26 million. Sales slipped 1.2% from one year ago. The median existing-home sales price rose 3.8% from February 2024 to $398,400, the 20th consecutive month of year-over-year price increases. The in

Mortgage Rates Recover After Starting Slightly Higher

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.78% -0.04% 15YR Fixed 6.23% -0.01% Mortgage Rates Recover After Starting Slightly Higher Mortgage rates hit their highest levels in just over 2 weeks yesterday and they were on track to remain unchanged today. In f

Tariffs could drive up new home prices by as much as $22,000, research finds

On Tuesday, President Donald Trump’s administration imposed new tariffs on imports from Canada and Mexico while increasing existing tariffs on goods from China, a move expected to raise prices for new homes, according to a recent CoreLogic report. That’s largely because tariffs affect essential home

New Jersey Real Estate Market Update: Trends in Long Branch, Monmouth County, & National Construction Insights

New Jersey Real Estate Market Update: Trends in Long Branch, Monmouth County, and National Construction Insights The real estate landscape is evolving rapidly, and staying informed is essential whether you're a seller, buyer, or investor. In this blog post, we explore the latest market updates for N

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265