-

What Is a REIT?

(Real Estate Investment Trust)

-

REITs, or real estate investment trusts, are companies that own or finance income-producing real estate across a range of property sectors. These real estate companies have to meet a number of requirements to qualify as REITs. Most REITs trade on major stock exchanges, and they offer a number of benefits to investors.

-

A real estate investment trust (“REIT”) is a company that owns, operates or finances income-producing real estate. REITs provide an investment opportunity, like a mutual fund, that makes it possible for everyday Americans—not just Wall Street, banks, and hedge funds—to benefit from valuable real estate, present the opportunity to access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

-

REITs allow anyone to invest in portfolios of real estate assets the same way they invest in other industries – through the purchase of individual company stock or through a mutual fund or exchange traded fund (ETF). The stockholders of a REIT earn a share of the income produced – without actually having to go out and buy, manage or finance property. Approximately 150 million Americans live in households invested in REITs through their 401(k), IRAs, pension plans, and other investment funds.

-

What assets do REITs own?

In total, REITs of all types collectively own more than $4.5 trillion in gross assets across the U.S., with public REITs owning approximately $3 trillion in assets. U.S. listed REITs have an equity market capitalization of more than $1.4 trillion.

U.S. public REITs own an estimated 535,000 properties and 15 million acres of timberland across the U.S.

REITs invest in a wide scope of real estate property types, including offices, apartment buildings, warehouses, retail centers, medical facilities, data centers, cell towers, infrastructure and hotels. Most REITs focus on a particular property type, but some hold multiples types of properties in their portfolios.

-

How Do REITs Make Money?

Most REITs operate along a straightforward and easily understandable business model: By leasing space and collecting rent on its real estate, the company generates income which is then paid out to shareholders in the form of dividends. REITs must pay out at least 90% of their taxable income to shareholders—and most pay out 100 %. In turn, shareholders pay the income taxes on those dividends.

mREITs (or mortgage REITs) don’t own real estate directly, instead they finance real estate and earn income from the interest on these investments.

-

Why invest in REITs?

REITs historically have delivered competitive total returns, based on high, steady dividend income and long-term capital appreciation. Their comparatively low correlation with other assets also makes them an excellent portfolio diversifier that can help reduce overall portfolio risk and increase returns. These are the characteristics of REIT-based real estate investment.

-

How have REITs performed in the past?

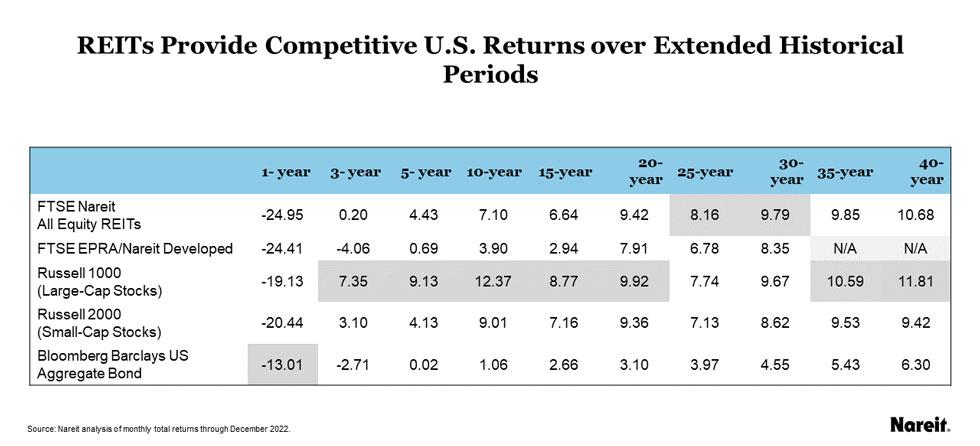

REITs' track record of reliable and growing dividends, combined with long-term capital appreciation through stock price increases, has provided investors with attractive total return performance for most periods over the past 45 years compared to the broader stock market as well as bonds and other assets.

Listed REITs are professionally managed, publicly traded companies that manage their businesses with the goal of maximizing shareholder value. That means positioning their properties to attract tenants and earn rental income and managing their property portfolios and buying and selling of assets to build value throughout long-term real estate cycles.

This drives total return performance for REIT investors, who benefit from a strong, reliable annual dividend payout and the potential for long-term capital appreciation. For example, REIT total return performance over the past 20 years has outstripped the performance of the S&P 500 Index and other major indices–as well as the rate of inflation.

-

What are the different types of REITs?

1. Equity REITs – The majority of REITs are publicly traded equity REITs. Equity REITs own or operate income-producing real estate. The market and Nareit often refer to equity REITs simply as REITs.

2. mREITs – mREITs (or mortgage REITs) provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities and earning income from the interest on these investments.

3. Public Non-listed REITs – Public, non-listed REITs (PNLRs) are registered with the SEC but do not trade on national stock exchanges.

4. Private REITs – Private REITs are offerings that are exempt from SEC registration and whose shares do not trade on national stock exchanges.

-

How to invest in REITs

An individual may buy shares in a REIT, which is listed on major stock exchanges, just like any other public stock. Investors may also purchase shares in a REIT mutual fund or exchange-traded fund (ETF).

A broker, investment advisor or financial planner can help analyze an investor’s financial objectives and recommend appropriate REIT investments.

Investors also have the ability to invest in public non-listed REITs and private REITs.

-

How does a company qualify as a REIT?

To qualify as a REIT a company must:

* Invest at least 75% of its total assets in real estate

* Derive at least 75% of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate

* Pay at least 90% of its taxable income in the form of shareholder dividends each year* Be an entity that is taxable as a corporation

* Be managed by a board of directors or trustees

* Have a minimum of 100 shareholders

* Have no more than 50% of its shares held by five or fewer individuals