A Summer Surprise: Labor Market Slump in July 2025

A Summer Surprise: Labor Market Slump in July 2025

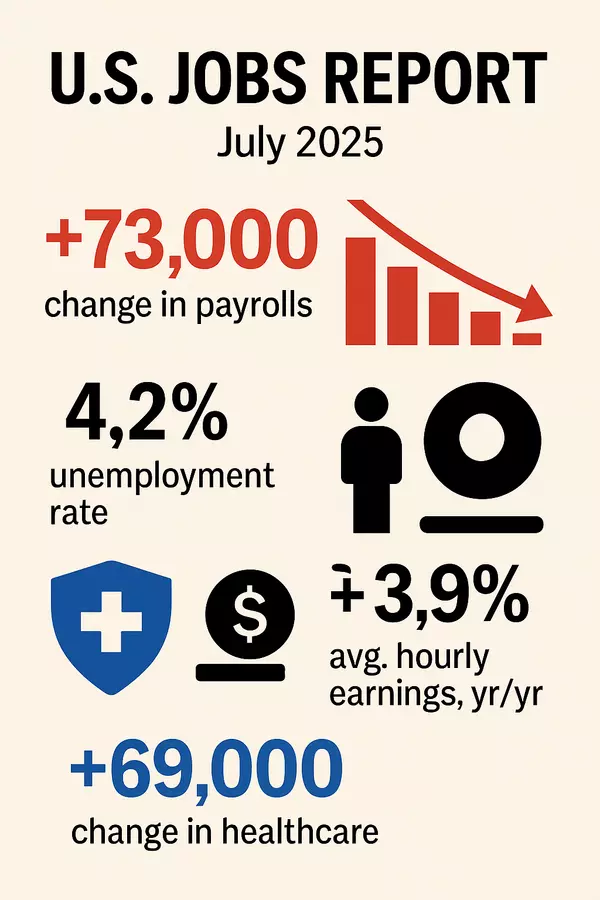

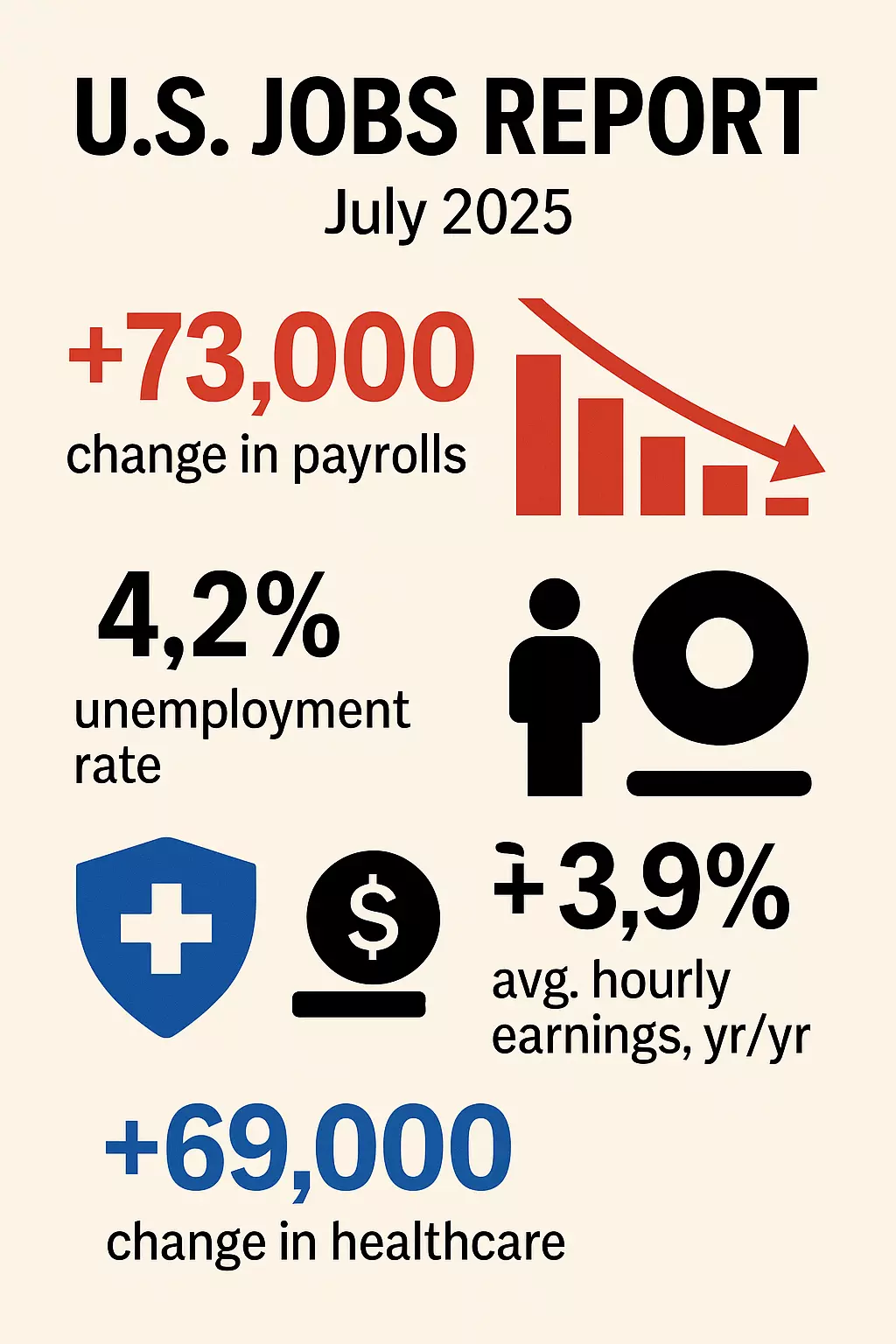

The U.S. job market took an unexpectedly sharp turn in July. Employers added just 73,000 jobs, far below expectations and a steep drop from revised June and May figures (Investors.com, The Washington Post). At the same time, May and June job totals were slashed by a combined 258,000, marking the most dramatic non-pandemic data revisions since the 1970s (The Washington Post).

👷♀️ Sector by Sector: Who’s Hiring and Who’s Not

Nearly all of July’s job growth came from healthcare and social assistance, accounting for around 94% of net gains. In contrast, manufacturing, professional services, administrative support, and federal government jobs either shrank or stagnated (The Washington Post). This means other traditional drivers of hiring are now in retreat.

Macro Signals: Unemployment, Wages, & Workforce Dynamics

-

The unemployment rate rose slightly to 4.2% in July, compared to 4.1% in June (The Washington Post).

-

Labor force participation fell modestly to about 62.2%, and the employment–population ratio also declined (Business Insider).

-

Meanwhile, average hourly earnings climbed 3.9% year-over-year, with an average wage of roughly $36.44 per hour (Business Insider).

-

Initial unemployment claims ticked up slightly to about 218,000, the first increase in seven weeks—but still historically low and not signaling layoffs yet (The Washington Post).

What’s Behind the Cooling?

Several headwinds are contributing to the hiring slowdown:

-

Trump administration tariffs and trade uncertainty have dampened hiring, especially in import-dependent industries (Investors.com).

-

Immigration policy changes have coincided with over 1.6 million foreign-born workers exiting the labor force since March, tightening available labor (The Washington Post).

-

Falling job openings and quit rates point toward a general softening in labor demand and mobility (Business Insider, The Washington Post).

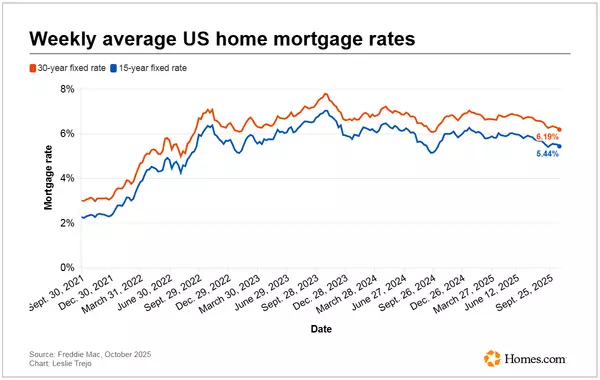

Fed Outlook: Rate Cut Expectations Rise

With labor markets cooling more than anticipated, markets and policymakers are increasingly anticipating a Federal Reserve interest rate cut as early as September. Before the report, chances hovered around 38%; afterward, they surged toward 70% (Business Insider, Investors.com).

Despite the weaker numbers, the Fed’s Jerome Powell described the labor market as in “balance,” while also warning of downside risks given the simultaneous decline in demand and supply (Business Insider).

Why It Matters: The Broader Implications

-

The big downward revisions remind us of the challenges in real-time labor tracking—these numbers reshape the narrative for the entire spring.

-

Healthcare’s outsized role in driving job growth may reflect demographic demand—but also highlights the unevenness of recovery across sectors.

-

Young and entry-level workers may find opportunities shrinking as jobs in tech, office admin, and early-career roles flatten or contract.

-

Rising wages—even amid weaker hiring—suggest underlying inflationary pressure, complicating the Fed’s dual mandate on growth and prices.

Bottom Line

The July 2025 jobs report revealed a slower and weaker labor market than policymakers and investors expected. With just 73,000 jobs added, steep revisions to earlier months, and signals of cooling across sectors, the economic momentum appears to have cooled significantly. Yet, stable wage growth and low layoffs offer some cushion. All eyes now turn toward the Fed and whether policymakers adjust the interest rate trajectory in response.

Let me know if you’d like a data visualization or deeper dive into any industry trends.

Recent Posts