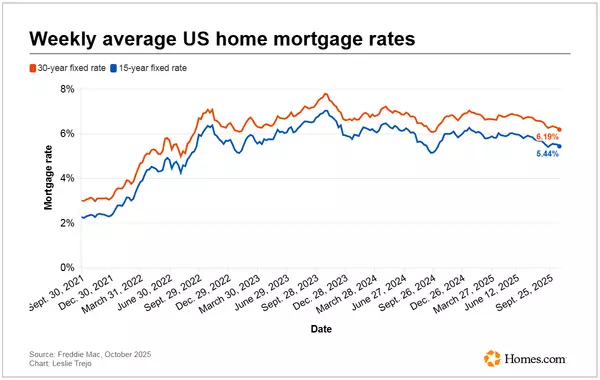

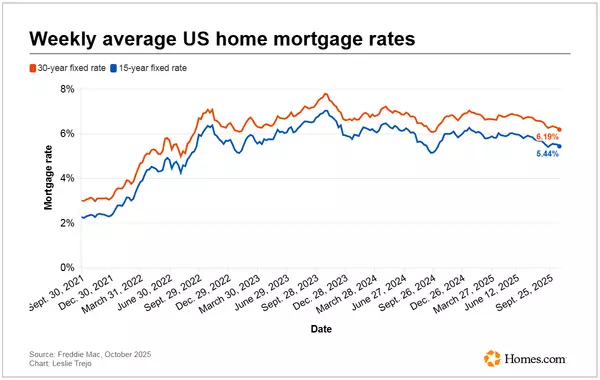

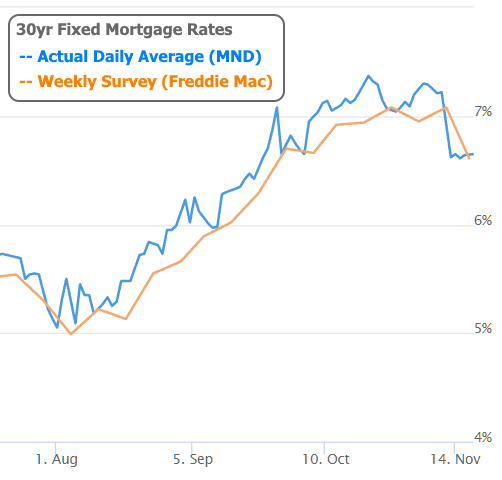

There's no question that last week was an exciting one for rates. On Wednesday, the average 30yr fixed was fairly close to the highest levels since 2002. The following afternoon, it had fallen more than half a percent to the lowest level in nearly 2 months--the biggest single day drop on record.

While rates are still very high relative to anything but the past 8 weeks, it was a promising step in the right direction. It raised hopes for a bigger picture shift after the fastest rate spike in 40 years.

As the new week got underway, rates managed to hold onto their newfound gains relatively well and with minimal volatility on average. Things may have been better were it not for a concerted effort on the part of the Fed to remind the market not to get too excited about additional declines.

Why is the Fed trying to rain on our parade?

First, let's examine what was said by various Fed speakers. Here are a few examples (paraphrased):

- Waller: Thursday's CPI report was just one data point. Markets are "way out in front."

- Harker: Inflation will take time to come down. I don't like to base policy on a couple of headline numbers

- George: It would make sense to slow the pace of rate hikes next year

- Daly: Inflation data is good news, but "pausing" is not being discussed

- Waller: Inflation data makes a case for a 0.5% increase instead of 0.75%

- Collins: Fed has more work to do, needs to hike rates more

- Bullard: Fed needs to hike to at least 5%, even if inflation data remains friendly

- Kashkari: Some evidence of inflation plateau, but can't be persuaded by 1 month of data. Hikes will continue into 2023

If you're thinking that's a lot of Fed members saying/thinking the same thing, you're right. They are extremely unified in saying that more rate hikes are coming and that it will take more than 1 month of rate-friendly inflation/economic data before they would consider pausing rate hikes.

After that, they're all also tremendously unified in saying that they want to keep rates at the "pause" level for as long as possible to make sure inflation has been truly defeated. They've also all acknowledged that such a stance involves economic pain and that is a requirement of these sorts of policy actions. In fact, they will be measuring their success in the form of a moderate amount of economic pain. In other words, they want to see unemployment move slightly higher and spending move slightly lower. As perverse as that may sound, they feel the economic pain that would result from unchecked inflation would be significantly worse.

That's the attitude the Fed brought to the market this week, and it was probably a good thing. Despite all of the raining on our parade, rates managed to remain in much lower territory relative to recent highs. Had the Fed not brought the bucket of cold water (especially Bullard. See the next chart of Fed rate expectations for June 2023), there was a risk the market could have gotten a bit carried away, reading too much into one month of inflation data.

This exuberance will continue to be a risk in an environment where rates have risen as quickly as they have in 2022 and where we know exactly which data matters most in identifying a shift (i.e. inflation data). That said, any near term risks pale in comparison to December 13th and 14th when we'll get the next installment of the Consumer Price Index (CPI) followed by the Fed announcement.

To be clear, CPI was the report that sparked the epic drop in rates last week, and has been the most important input for rates in 2022 when it comes to scheduled economic data.

The outcome of the Dec 13th report will be critical in helping the Fed lock in an amount to hike rates the following day. Markets currently expect the hike to be 0.50%, but a hot inflation report would easily put 0.75% back on the table. In addition to the hike itself, December is also one of 4 Fed meetings that brings the release of updated Fed rate hike forecasts--something that the market is always keen to react to.

It's unclear what the rate reality will be between now and then. We have almost a month to sit back and observe. Much of that time will be occupied by holiday-related idiosyncrasies for financial markets. This can add to volatility for several reasons. To be sure though, the incoming economic data will continue to play a role in shaping the market's expectations heading into the December 13th CPI report.

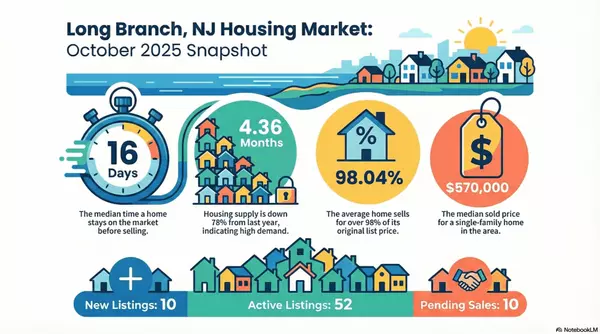

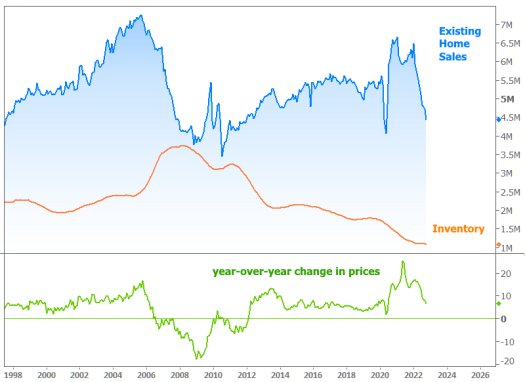

Not all data is created equal in this regard. Several of this week's reports were "interesting," but they didn't necessarily have a big impact. Existing Home Sales dropped yet again, but the negative implications are somewhat offset by an incredibly tight inventory picture and the persistence of year-over-year price gains (this doesn't mean prices aren't falling, only that they're still higher than the same month last year, which is more than prices could say for themselves in 2007, the last time sales fell at a similar pace).

Adjusting for the inventory crunch, we find sales are much higher than the last major downturn, and much closer to the few years leading up to the pandemic.

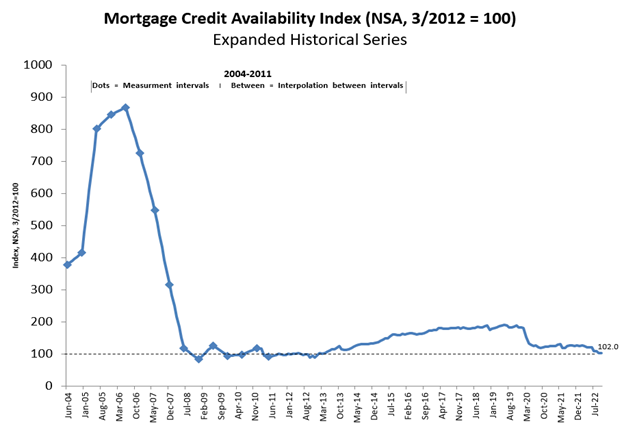

The big question is whether that blue line will continue dropping until it looks like it did in 2008. The Mortgage Bankers Association has a useful chart in this week's credit availability index to remind us why one of these things is not like the other. It shows how free-flowing mortgage credit was prior to the meltdown, and how it is currently about as tight as it ever has been.

Point being: lenders aren't out there making the same sort of reckless loans this time around--not even remotely close.

Looking ahead, next week will only contain 3.5 business days for the bond market due to the Thanksgiving holiday. During that time, there are only a handful of economic reports and all of them hit on Wednesday morning. Traditionally, it can be a volatile week for the bond market (and thus rates), but mortgage lenders also traditionally build a bit of a cushion into rates in the days leading up to the holiday (that includes the current week for many lenders). Even then, barring an unforeseen shock, rates would be waiting to make their bigger moves until after the Dec 13th CPI data.