The Cost of Waiting for Mortgage Rates To Go Down

Mortgage rates have increased significantly in recent weeks. And that may mean you have questions about what this means for you if you’re planning to buy a home. Here’s some information that can help you make an informed decision when you set your homebuying plans.

The Impact of Rising Mortgage Rat

How an Expert Can Help You Understand Inflation & Mortgage Rates

If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one.

Inflation and the Housing Market

This year, inflation reached a high not seen in forty years. For the average consumer, you probably felt the p

What Experts Say Will Happen with Home Prices Next Year

Experts are starting to make their 2023 home price forecasts. As they do, most agree homes will continue to gain value, just at a slower pace. Over the past couple of years, home prices have risen at an unsustainable rate, leaving many to wonder how long it would last. If you’re asking yourself:

Top Reasons Homeowners Are Selling Their Houses Right Now

Some people believe there’s a group of homeowners who may be reluctant to sell their houses because they don’t want to lose the historically low mortgage rate they have on their current home. You may even have the same hesitation if you’re thinking about selling your house.

Data shows 51% of hom

Will My House Still Sell in Today’s Market?

Will My House Still Sell in Today’s Market?

If recent headlines about the housing market cooling and buyer demand moderating have you worried you’ve missed your chance to sell, here’s what you need to know. Buyer demand hasn’t disappeared, it’s just eased from the peak intensity we saw over the pa

August 2022 Monthly Housing Market Trends Report

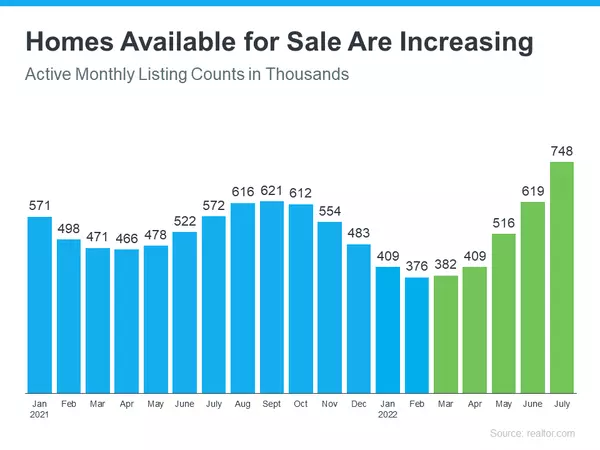

The national inventory of active listings increased by 26.6% over last year.

The total inventory of unsold homes, including pending listings, increased by just 1.3% year-over-year due to a decline in pending inventory (-21.9%).

Selling sentiment declined and listing activity followed, with newl

Buyers Are Regaining Some of Their Negotiation Power

If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling like you may need to waive contingencies or pay drastically over asking price to get your offer considered may be

Getting Your House Ready To Sell? Work with an Experienced Agent for Advice

In a market that’s shifting as fast as it is today, many homeowners wonder what, if anything, needs to be renovated before they sell their house. That’s where a trusted real estate professional comes in. They can help you think through today’s market conditions and how they impact what you should –

Mortgage App Volume Declines, But Jobs Data Offers Silver Lining

The Mortgage Bankers Association (MBA)says the pace of mortgage applications slowed fora fourth consecutive time during the week ended September 2. MBA’sseasonally adjustedMarket Composite Index, a measure of application volume, decreased 0.8 percent headinginto the long Labor Day holiday weekend. O

Expert Forecasts on Mortgage Rates %

Expert Forecasts on Mortgage Rates

If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues to slow?

As you think about you

How Owning a Home Builds Your Net Worth

How Owning a Home Builds Your Net Worth

Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner gives your net worth a big boost. And with high inflation right now, the link between owning your home and building your w

A Trusted Real Estate Advisor Provides Expert Advice

A Trusted Real Estate Advisor Provides Expert Advice

If you’re a homeowner or are planning to become one soon, you’re probably looking for clear information about today’s housing market. And if you’ve turned to the news or even just read headlines recently, you might feel like you’re left with mor

Why You May Want To Start Your Home Search Today

Why You May Want To Start Your Home Search Today

If you’re thinking about buying a home, you likely have a lot of factors on your mind. You’re weighing your own needs against higher mortgage rates, today’s home prices, and more to try to decide if you want to jump into the market. While some buyer

3 Tips for Buying a Home Today

3 Tips for Buying a Home Today

If you put off your home search at any point over the past two years, you may want to consider picking it back up based on today’s housing market conditions. Recent data shows the supply of homes for sale is increasing, giving buyers like you additional options.

But

Planning To Retire? Your Equity Can Help You Reach Your Goal.

Planning To Retire? Your Equity Can Help You Reach Your Goal.

Whether you’ve just retired or you’re thinking about retirement, you may be considering your options and trying to picture a whole new stage of your life. And you’re not alone. Research from the Retirement Industry Trust Association (RIT

Experts Increase 2022 Home Price Projections

Experts Increase 2022 Home Price Projections

If you’re wondering if home prices are going to come down due to the cooldown in the housing market or a potential recession, here’s what you need to know. Not only are experts forecasting home prices will continue to appreciate nationwide this year, bu

Why Experts Say the Housing Market Won't Crash

Caption

Some Highlights

Many people remember the housing crash in 2008, but experts say today’s market is fundamentally different in many ways.

First, there isn’t an oversupply of homes for sale today. Plus, lending standards are much tighter, and homeowners have record levels of equity. That

Shifting Market a Challenge or an Opportunity for Homebuyers

Is the Shifting Market a Challenge or an Opportunity for Homebuyers?

If you tried to buy a home during the pandemic, you know the limited supply of homes for sale was a considerable challenge. It created intense bidding wars which drove home prices up as buyers competed with one another to be the w

Why It’s Still a Sellers’ Market

Why It’s Still a Sellers’ Market

As there’s more and more talk about the real estate market cooling off from the peak frenzy it saw during the pandemic, you may be questioning what that means for your plans to sell your house. If you’re thinking of making a move, you should know the market is stil

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265