Record-Setting Drop in Builder Confidence in July

Record-Setting Drop in Builder Confidence in July

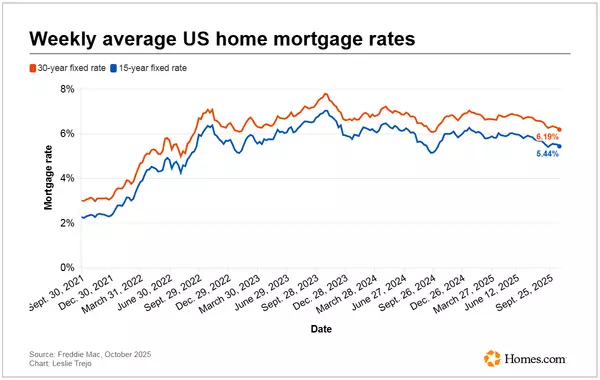

While neither index is anywhere near record lows, this was the biggest month-over-month drop on record (apart from the April 2020 reading which should arguably be thrown out as the survey hit at peak lockdown).

Does this mean the housing market is doomed to a worse fate than that seen in 2007/08? A different version of the same chart helps answer that question. This time around, the chart shows the change in confidence compared to the same month 3 years in the past. This does a much better job of showing boom/bust cycles in housing.

While housing is by no means facing the same headwinds that led up to the financial crisis, it's definitely cooling off rapidly. It also remains to be seen how that cooling resolves itself. If rates and inflation have peaked in 2022, this sort of contraction could end up looking more like a normalization that resets the board for a more stable housing market in 2023.

Recent Posts