As far as financial markets are concerned, a green Christmas is better than anything Bing Crosby could have crooned about. Green is the color that flashes when markets are improving or when interest rates are falling. Green, for lack of a better word, is good.

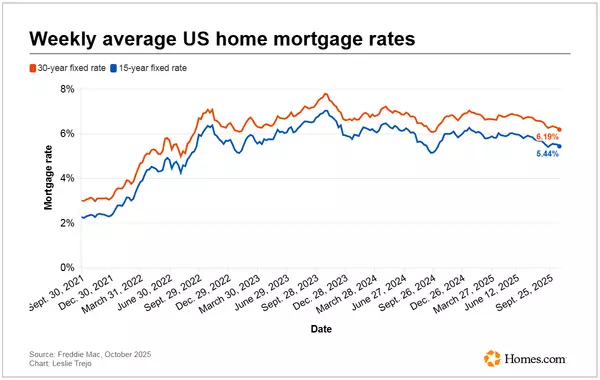

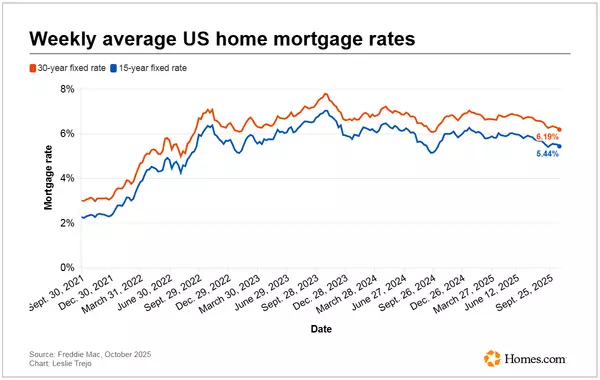

For mortgage rates, it's been an especially difficult year. They've risen at the fastest pace in 40 years to levels not seen for 20 years. They've gotten their hopes up a few times only to have them crushed more and more convincingly.

Despite being downtrodden, market participants knew that the bad times couldn't last forever. The higher rates went, the closer they were to the peak--even if that peak ended up being quite a bit higher than most anyone imagined earlier in the year.

To understand why rates went as high as they did and why there's renewed hope for a reversal, we need to remember that inflation has been the driving force. Every time inflation surprised to the upside, rates ratcheted abruptly higher.

Most recently though, inflation surprised to the downside when the most recent Consumer Price Index (CPI) data came out on November 10th. The result was the single best day for mortgage rates on record (in terms of day-over-day movement). This isn't the first time for such a surprise, but it's the most compelling. It sets the stage for the next CPI report to confirm a big picture shift in the inflation narrative.

CPI comes out on December 13th--not quite Christmas, but close enough to ensure lower rates through the end of the year if it shows inflation continues to cool. Of course there's a risk that rates move in the opposite direction if inflation bounces back up. Either way, the swings in underlying bond markets could be especially large as the Fed releases its next policy announcement on December 14th.

We know the Fed will hike rates, but they'll almost certainly be hiking by a smaller amount than last time (unless inflation comes in hot). How can we be so sure? Many Fed speakers said so last week. Now this week, the notion was confirmed by Fed Chair Powell on Wednesday.

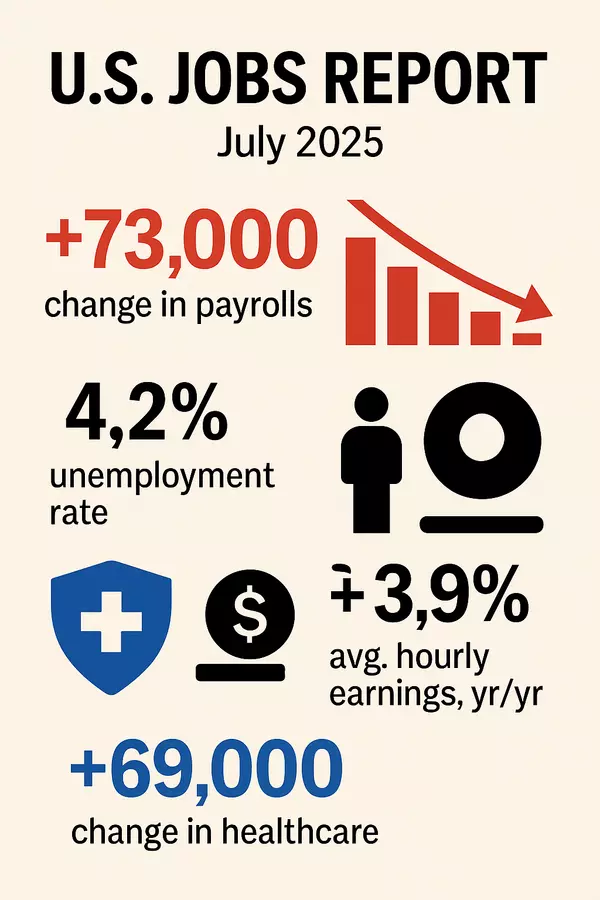

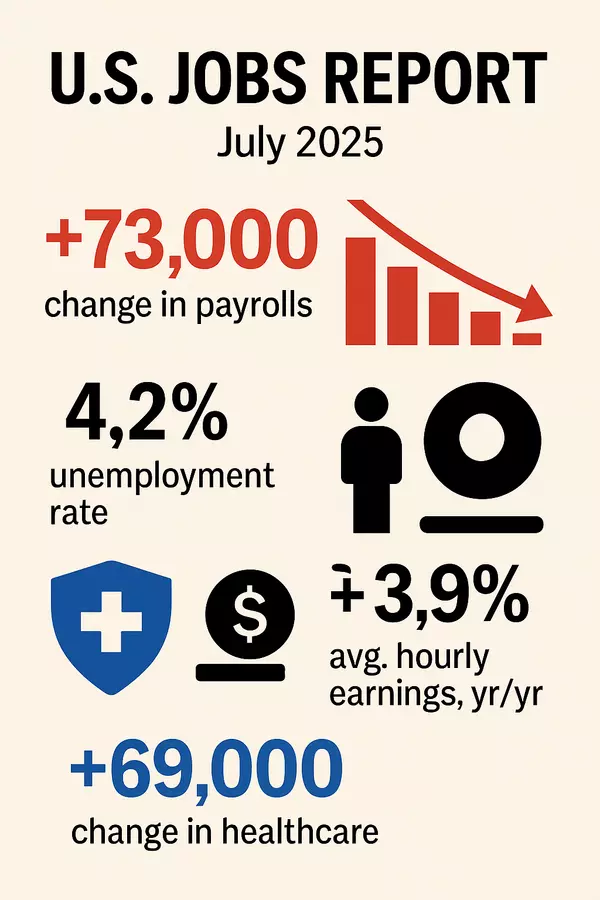

Rates responded by dropping sharply by Thursday morning, but the underlying bond market was having second thoughts by Friday morning owing to a strong jobs report. Officially called "The Employment Situation," the government's big jobs report is one of the only economic reports other than CPI that consistently registers a big response in the bond market (many reports move markets, but we're talking about BIG reactions).

Both stocks and bonds reacted on Friday because both stocks and bonds are imagining what the data suggests about the Fed's course of action in 2 weeks. We know the Fed cares about inflation first and foremost, but they've also pointed to the tight labor market as allowing them to hike rates aggressively with lower risk of adverse economic outcomes. In other words, if job creation is still so strong, they figure they might as well hike rates even more in order to defeat inflation.

We know the market was reacting to the implications for the Fed meeting because we can see correlated movement in the securities that traders actually use to bet on future Fed rate hikes (and cuts). The following chart shows how those expectations shifted after Powell's speech on Wednesday and then after the jobs report on Friday.

Stocks and bonds both gradually recovered throughout the day because markets know that the labor market is only a supporting actor in the Fed's decision. A strong jobs market ALLOWS the Fed to push rates aggressively higher, but it won't prevent the Fed from slowing the pace of rate hikes if inflation continues to subside. Additionally, the Fed knows it has a certain amount of tightening "in the pipeline." That means it has already hiked rates enough that inflation and the economy should increasingly respond, but that the response is far from immediate.

After all, rates may have moved sharply lower on 11/30 (this past Wednesday) and 11/10, but they're still much higher than they had been. The overall altitude of rates still presents a headwind to economic growth. The Fed knows it. The market knows the Fed knows it. And long term rates should continue to fall if the December 13th inflation data brings more evidence of the Fed's restrictive policies having the desired effect.