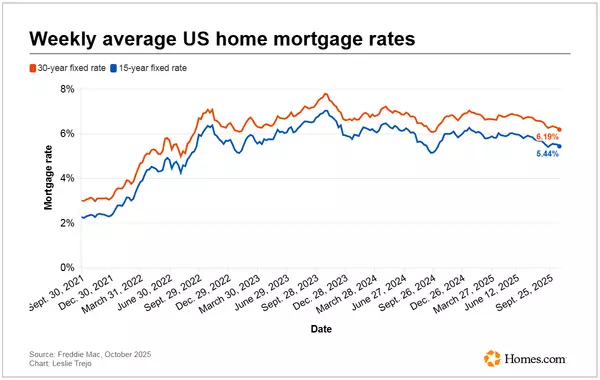

Mortgage Rates Down to Lowest Levels of The Year

|

|

Mortgage Rates Down to Lowest Levels of The Year

It's official! At this point, you'd need to go all the way back to the end of December 2023 to see a lower average rate for a top-tier, conventional 30-year fixed mortgage. Today's rates are already fairly close to those late-December levels. Any further improvement would result in the lowest levels since May 2023.

We were already at 6-month lows yesterday, so today didn't really change the game. That said, this most recent rally represents an extension of a broader rally that began in May, and that one is definitely a game changer. These past 3 months mark an abrupt shift in what had been a decisive uptrend in rates in Jan-April.

Rates don't necessarily "decide" to spend an entire month doing one specific thing, nor are they guaranteed to remain in the sorts of linear trends seen so far this year. There are good cases to be made for those trends aligning with the most relevant economic data and events.

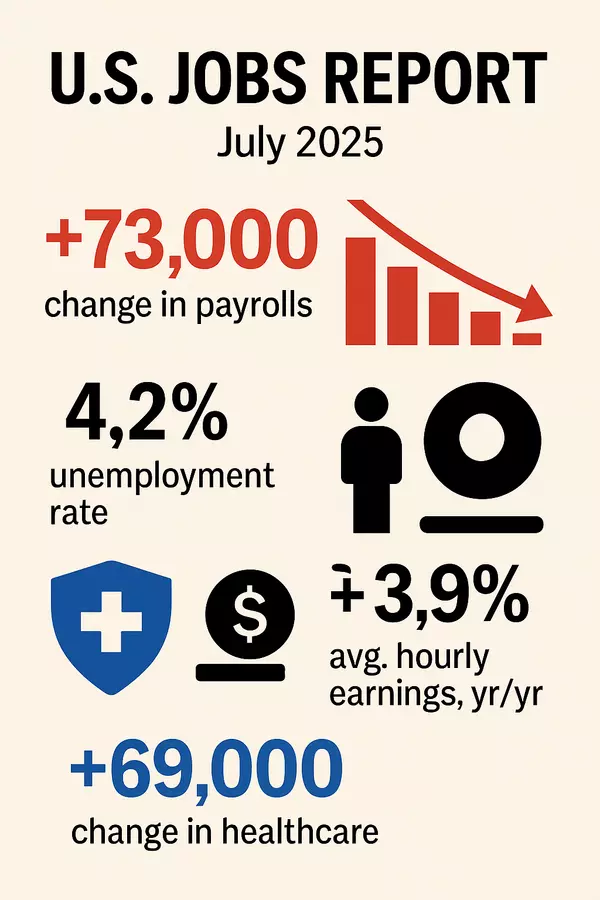

With that in mind, the events of the past 2 days clearly have the market thinking about additional rate-friendly economic data. Today's installment consisted of the highest Jobless Claims reading in a year and big miss in an important manufacturing sector index. This data caused rapid improvement in the bond market which, in turn, allowed mortgage lenders to set lower rates today.

Tomorrow's economic data is an order of magnitude more important than today's. The Employment Situation (aka "the jobs report") will be released at 8:30am ET. It is one of the two most important reports on any given month and easily has the power to cause a big move for rates in either direction.

Recent Posts