How do I get pre-approved for a mortgage?

Getting pre-approved for a mortgage is a crucial step in the home buying process. It allows buyers to know how much they can afford to spend on a home and shows sellers that they are serious about making an offer. But how exactly do you get pre-approved for a mortgage? In this blog, we’ll walk you through the stages of getting pre-approved for a mortgage.

Step 1: Gather Your Financial Information

The first step in getting pre-approved for a mortgage is to gather your financial information. This includes your income, assets, and debts. You will need to provide documents such as pay stubs, W-2s, tax returns, bank statements, and investment account statements. Having this information ready and organized will save you time and make the process smoother.

Step 2: Choose a Lender

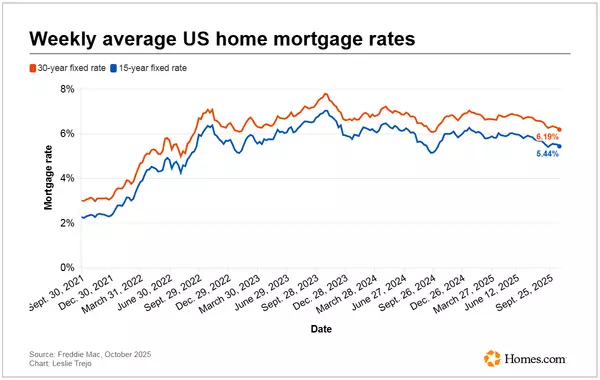

The second step is to choose a lender to work with. You can get pre-approved for a mortgage through a bank, credit union, or mortgage broker. It’s important to shop around and compare rates and fees from different lenders. You can also ask for recommendations from friends and family who have recently gone through the home buying process.

Step 3: Submit an Application

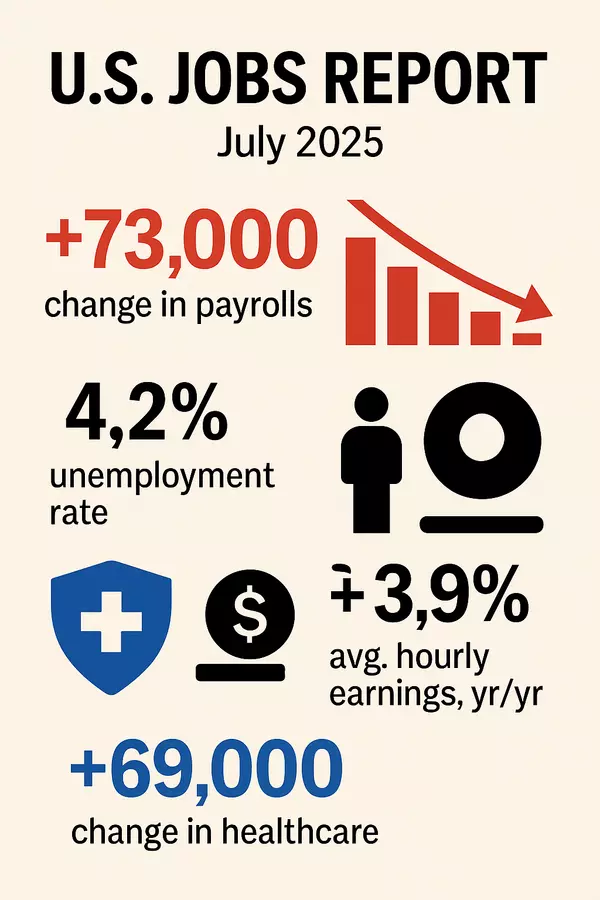

Once you’ve chosen a lender, you will need to submit a mortgage application. This can be done online, over the phone, or in person. The application will ask for your personal and financial information, such as your income, employment history, and credit score. Be prepared to answer questions about the type of home you are looking to buy and how much you are planning to put down as a down payment.

Step 4: Provide Documentation

After submitting your application, you will need to provide documentation to support your financial information. This includes the documents mentioned in step one, such as pay stubs and tax returns. Your lender may also request additional documents, such as proof of insurance or a copy of the sales contract for the home you are purchasing.

Step 5: Wait for Approval

Once you’ve submitted your application and provided all the necessary documentation, you will need to wait for approval. The lender will review your application and determine how much you are pre-approved to borrow. This amount will be based on your income, credit score, and other factors. If you are approved, you will receive a pre-approval letter from the lender.

Step 6: Shop for a Home

With your pre-approval letter in hand, you can start shopping for a home. It’s important to keep in mind that your pre-approval amount is not necessarily the amount you should spend on a home. You should consider your monthly budget and other expenses when deciding how much to spend. You should also work with a real estate agent who can help you find homes that fit your budget and needs.

In conclusion, getting pre-approved for a mortgage is an important step in the home buying process. By following these six stages, you can get pre-approved and start shopping for your dream home. Remember to gather your financial information, choose a lender, submit an application, provide documentation, wait for approval, and then shop for a home. With pre-approval in hand, you’ll be one step closer to owning the home of your dreams.

Recent Posts