Experts: Housing Market Likely to ‘Normalize’ in 2022

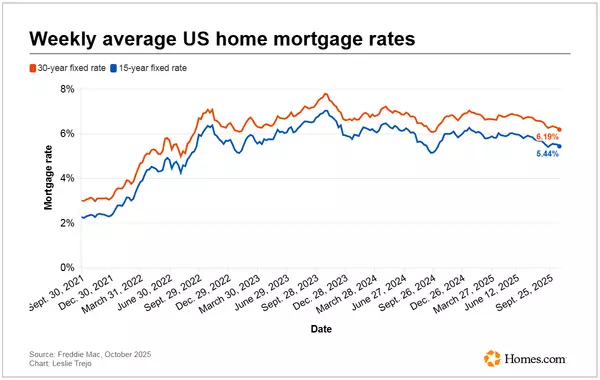

While strong homebuyer demand and inventory shortages will continue into 2022, the housing market is unlikely to repeat this year’s dizzying heights, in which existing-home sales reached their highest point in 15 years with an estimated 6 million sales. Slower growth in home prices, decelerating inflation, and multiple interest rate hikes by the Federal Reserve could contribute to a more normal housing market in the new year, National Association of REALTORS® Chief Economist Lawrence Yun said Wednesday during NAR’s virtual Real Estate Forecast Summit. Yun presented a consensus real estate forecast based on a survey of 20 leading economists.

For 2022, the group of experts predicts that annual median home prices will increase 5.7% and inflation will rise 4%. “Overall, survey participants believe we’ll see the housing market and broader economy normalize next year,” Yun said. In addition, Yun expects existing-home sales will decline to 5.9 million in 2022 and housing starts will increase modestly to 1.67 million as the pandemic’s supply chain backlogs subside.

Housing affordability remains a concern. Even if the market begins to settle down, affordability issues likely will continue to dampen homebuying prospects for many would-be owners. Housing affordability had already reached crisis levels before the pandemic added to the strain, said Todd M. Richardson, general deputy assistant secretary at the Department of Housing and Urban Development’s Office of Policy Development and Research.

However, the Biden administration’s Build Back Better plan offers several programs that have the potential to increase housing access for all. The bill provides $10 billion in down payment assistance for first-generation home buyers, $24 billion for housing choice voucher rental assistance, and $15 billion for the Housing Trust Fund to build and preserve over 150,000 affordable homes for low-income households. “Our programs are about unlocking possibilities,” said Richardson. “Support is needed most for housing in low- to moderate-income communities.”

Manufactured housing offers a potential source of inventory that could help ease the housing crunch. Affordable entry-level homes continue to be among the units in shortest supply, and modern manufactured housing—with its high-quality factory construction and lower per-unit cost—could help fill in some of the gaps, said Lesli Gooch, CEO of the Manufactured Housing Institute. In addition, manufactured homes could offer wealth-building opportunities for buyers. “Research by LendingTree shows that, from 2014 to 2019, the median value of manufactured homes increased by 40%—six points above site-built homes,” said Gooch.

Naa Awaa Tagoe, acting deputy director at the Division of Housing Mission and Goals at the Federal Housing Finance Agency, seconded the call for more affordable housing and shared her agency’s strategies in 2022 for increasing equitable access to homeownership and rentals. Appraisal efficiency, small-balance mortgage purchases and refinances, and low-income housing tax credits are among the division’s top priorities for 2022, said Tagoe.

Regional differences could affect the housing market. Housing prices are likely to moderate nationwide, but regional variation could occur in 2022. Overpriced areas with lower predicted population growth will experience a greater slowing of prices compared to those with higher predicted growth, said Ken H. Johnson, associate dean of graduate programs at Florida Atlantic University. “Everyone will experience moderation, but there will be differences,” he said.

Strong building starts in the suburbs could be good news for first-time buyers. Businesses are competing for workers right now, said realtor.com® Chief Economist Danielle Hale, and that means buyers could have more flexibility in choosing where they live. In contrast to Yun, who saw “hidden gem real estate markets” in the South, Hale counseled would-be buyers to look further north. “The Mountain West, pockets of the Northeast, South, and Midwest are all locations where affordability creates incentives,” said Hale.

Demographics offer insight into the future. Jessica Lautz, NAR’s vice president of behavioral insights and demographics, offered highlights from the 2021 Profile of Home Buyers and Sellers, noting several demographic trends that will continue to affect the housing market into 2022 and beyond:

- Baby boomers want to age in place and will continue to hold onto their homes, contributing to the ongoing inventory shortfall.

- Millennials are the largest generation of potential buyers, but they face significant headwinds, such as low inventory, high prices, and student loan debt.

- A drop in the birth rate to a 100-year low could contribute to continued stagnation in the market: The birth of a child is often a motive to buy, and a child moving out is often an impetus to downsize and sell.

Recent Posts