Mortgage Rates Jumped Over 7% This Week, Even if You Heard They Were 6.71%

|

||||

|

|

||||

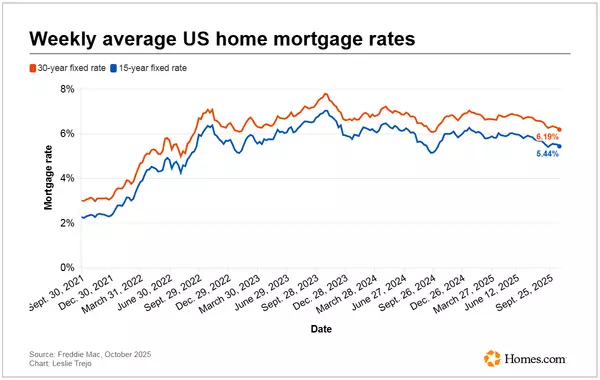

Mortgage Rates Jumped Over 7% This Week, Even if You Heard They Were 6.71%Mortgage rates have been hovering in the high 6's for weeks, but they broke above 7% on Thursday. At the same time, multiple news outlets reported a 30yr fixed rate of 6.71%. Who's lying? While the 6.71% news may be prolific, it is all traced back to one source: Freddie Mac's weekly rate survey. This is the longest-standing mortgage rate index in the US and the most widely cited. It does a great job of capturing general levels over the long run, but it doesn't necessarily line up with the reality in the trenches on any given day. Here's the reality: 6.71% implies widespread availability of 6.625% and 6.75% (rates are most frequently offered in .125% increments, and 6.71% is an average). You could certainly get a rate of 6.625% if your scenario, credit, and down-payment were ideal, but at the average lender, you'd be paying a bit more upfront. In other words, you'd be paying "points" in some form or another. Freddie's survey used to collect information on points. It no longer does. That means a loan at 6.625% with 1 point is counted the same as a loan at 6.625% and no points. But those two loans are not the same. In fact, a point is worth roughly 0.50% in rate! So the "no point" equivalent of 6.625% is actually 7.125%. The other complicating factor is that Freddie reports the average rate over the preceding 5 business days. In this week's case, rates were in the process of jumping on Thursday--a day that won't be reflected in Freddie's numbers until next week. With all that in mind, it's less of a surprise to consider that MND's rate index (which accounts for points) jumped back over 7% on Thursday and has been running slightly higher in general.

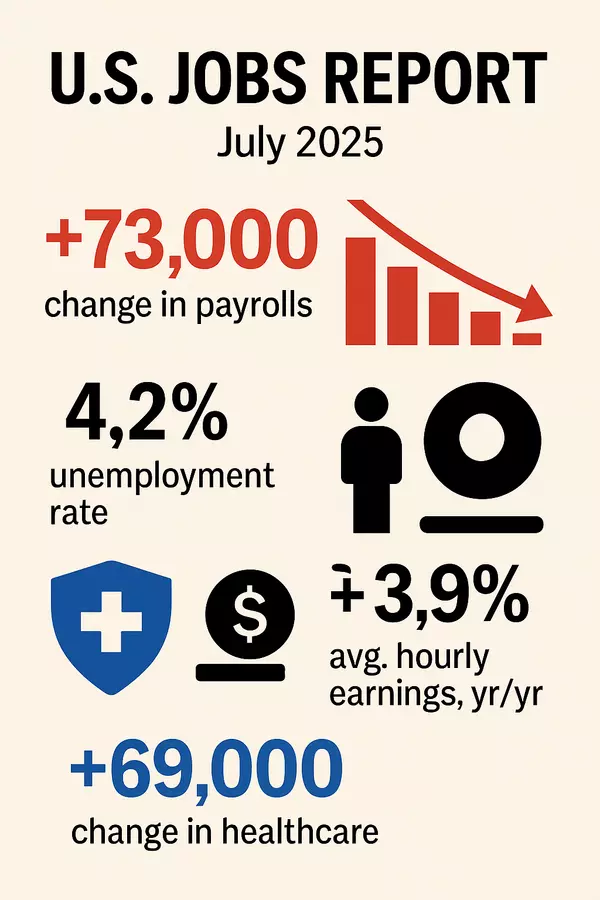

Thursday's jump was driven by data. Both GDP and Jobless Claims data turned out to be stronger than expected. Strong data tends to push rates higher--especially at present when market participants know that economic resilience means a resumption of rate hikes from the Fed. The Fed doesn't set mortgage rates directly, but expectations for future hikes correlate with mortgage rate movement.

And here's a closer look at how Fed rate expectations evolved this week:

We can get more perspective on recent rate movement by examining 10yr Treasury yields, which tend to move much like mortgage rates. Last week, we examined a 10yr yield range between 3.72 and 3.84%. This has been a mostly boring sideways grind as the market waits for data like Thursday's. Interestingly enough, Thursday just barely resulted in a challenge to the ceiling, and yields were back in the range by Friday.

What's the significance? It simply speaks the indecision that continues plaguing the rate market. This range is a drop in the bigger picture bucket. It will take much bigger moves driven by much more data to create meaningful change in the rate landscape.

In this week's housing-related data, home prices defied expectations with FHFA's index rising 0.7% in April. Case Shiller's index was expected to fall 2.6%, but fell only 1.7% over the same time (it is more volatile than FHFA).

New Home Sales came in much higher than expected, and have generally been the saving grace for home sales data as high rates keep homeowners reluctant to give up the low rates on their existing homes.

|

Recent Posts