Building Permits Fall Well Below Housing Starts For First Time in Over 2 Years

30YR Fixed 6.38% +0.11% 15YR Fixed 5.54% +0.02% Building Permits Fall Well Below Housing Starts For First Time in Over 2 Years Housing Starts, the jargon word used to refer to the inception of new residential construction, have a reasonably logical relationship with building permits. The latter t

Homeowners Still Have Positive Equity Gains over the Past 12 Months

If you’re a homeowner, your net worth got a big boost over the past few years thanks to rapidly rising home prices. Here’s how it happened and what it means for you, even as the market moderates. Equity is the current value of your home minus what you owe on the loan. Because there was a significant

Mortgage Rates Are Dropping. What Does That Mean for You?

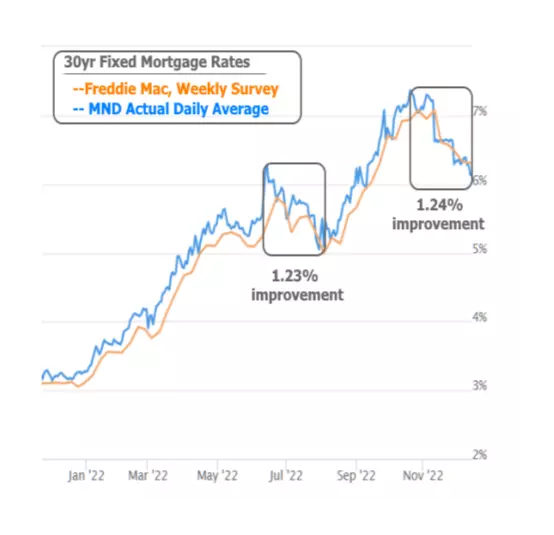

Mortgage Rates Are Dropping. What Does That Mean for You? Mortgage rates have been a hot topic in the housing market over the past 12 months. Compared to the beginning of 2022, rates have risen dramatically. Now they’re dropping, and that has to do with everything happening in the economy. Nadia Eva

Best Winning Streak For Rates in 2 Years

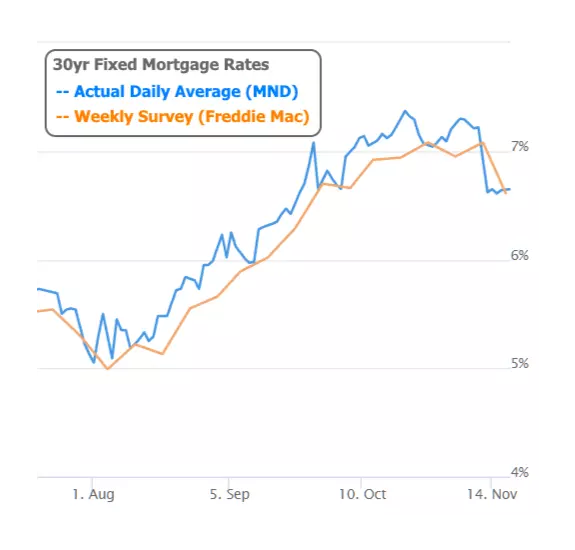

30YR Fixed 6.17% +0.04% 15YR Fixed 5.48% +0.03% Best Winning Streak For Rates in 2 Years It was a critical week for financial markets and especially for rates as investors digested the latest inflation data and the Fed's smaller rate hike. In fact, the latest inflation data could be thought of as

You May Have More Negotiation Power When You Buy a Home Today

Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has moderated and housing supply has grown. Those two factors combined mean you may see less competi

Rates Dream of Green Christmas With Help From The Fed

30YR Fixed 6.34% +0.05% 15YR Fixed 5.78% +0.03% Rates Dream of Green Christmas With Help From The Fed As far as financial markets are concerned, a green Christmas is better than anything Bing Crosby could have crooned about. Green is the color that flashes when markets are improving or when intere

Mortgage Rates Drop Sharply, Hitting Lowest Levels Since Mid-September

30YR Fixed 6.29% -0.34% 15YR Fixed 5.75% -0.23% Mortgage Rates Drop Sharply, Hitting Lowest Levels Since Mid-September Mortgage rates had been in a holding pattern for nearly 3 weeks following the November 10th CPI inflation data. On that single day, the average 30yr fixed rate fell by a reco

$726,200 is The New Loan Limit for 2023; Monmouth County Now Over $1m

30YR Fixed 6.29% -0.34% 15YR Fixed 5.75% -0.23% $726,200 is The New Loan Limit for 2023; High Cost Counties Now Over $1m If you're just here for the conforming loan limit news, $726,200 is the number for 2023. Does this mean no one can get a mortgage for more than $726,200? No. The conforming

Why There Won’t Be a Flood of Foreclosures Coming to the Housing Market

With the rapid shift that’s happened in the housing market this year, some people are raising concerns that we’re destined for a repeat of the crash we saw in 2008. But in truth, there are many key differences between what’s happening today and the bubble in the early 2000s. One of the reasons this

Pending Home Sales Decline for Fifth Month in a Row

96 Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.65% +0.03% 15YR Fixed 6.00% -0.02% Pending Home Sales Decline for Fifth Month in a Row October saw contracts to purchase existing homes fall for the fifth straight month. The National Association of Realtors®

3 Ways You Can Use Your Home Equity

If you’re a homeowner, odds are your equity has grown significantly over the last few years as home prices skyrocketed and you made your monthly mortgage payments. Home equity builds over time and can help you achieve certain goals. According to the latest Equity Insights Report from CoreLogic, the

What Buyers Need To Know About the Inventory of Homes Available for Sale

⇒ If you’re thinking about buying a home, you’re likely trying to juggle your needs, current mortgage rates, home prices, your schedule, and more to try to decide if you want to jump into the market. If this sounds like you, here’s one key factor that could help you with your decision: there are mor

What Homeowners Want To Know About Selling in Today’s Market

If you’re thinking about selling your house, you’re likely hearing about the cooling housing market and wondering what that means for you. While it's not the peak intensity we saw during the pandemic, we’re still in a sellers’ market. That means you haven’t missed your window. Realtor.com explains:

Mortgage Rates Will Come Down, It’s Just a Matter of Time

This past year, rising mortgage rates have slowed the red-hot housing market. Over the past nine months, we’ve seen fewer homes sold than the previous month as home price growth has slowed. All of this is due to the fact that the average 30-year fixed mortgage rate has doubled this year, severely li

Fed Says: Don't Get Too Excited About Rates Just Yet

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.63% -0.02% 15YR Fixed 6.05% -0.05% Fed Says: Don't Get Too Excited About Rates Just Yet There's no question that last week was an exciting one for rates. On Wednesday, the average 30yr fixed was fairly close to the

More People Are Finding the Benefits of Multigenerational Households Today

If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational l

Top Questions About Selling Your Home This Winte

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decisio

Construction Costs, Buyer Traffic Continue to Sap Builder Confidence

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.64% +0.03% 15YR Fixed 6.08% +0.03% Construction Costs, Buyer Traffic Continue to Sap Builder Confidence The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) fell another 5 point

Mortgage Rates Roughly Unchanged After Last Week's Huge Drop

Ryan Skove has shared this article with you. View | Download 30YR Fixed 6.61% -0.04% 15YR Fixed 6.05% -0.07% Mortgage Rates Roughly Unchanged After Last Week's Huge Drop If you're just getting caught up, last Thursday was one for the record books--at least when it comes to the daily reco

What’s Ahead for Mortgage Rates and Home Prices?

What’s Ahead for Mortgage Rates and Home Prices? Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265