Highest Purchase Applications in a Year? Technically, Yes

Ryan Skove has shared this article with you. View | Download

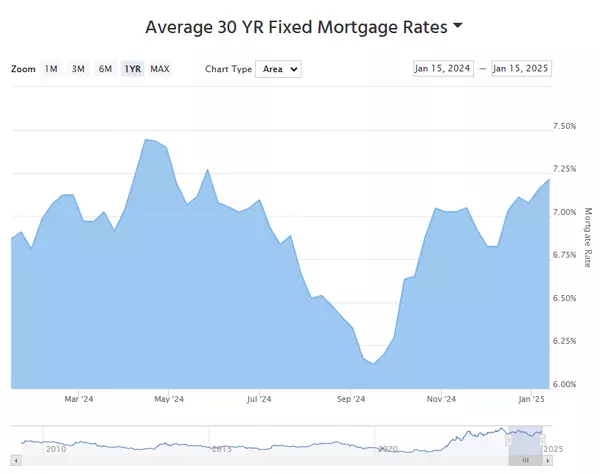

30YR Fixed

7.11%

-0.01%

15YR Fixed

6.51%

-0.01%

Mortgage Rate Watch - Jan 15th 2025

Ryan Skove has shared this article with you.

Download PDF

View on Web

30 YR Fixed

7.13%

-0.12%

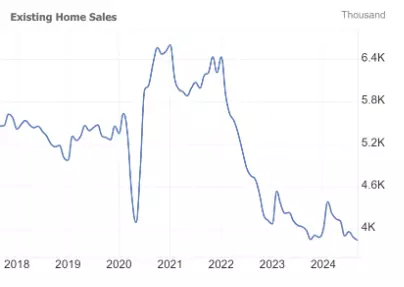

Existing Home Sales Update: Still Bad

30YR Fixed

7.09%

+0.07%

15YR Fixed

6.48%

-0.02%

Existing Home Sales Update: Still Bad

Housing was chugging right along in early 2020, then covid happened. Housing experienced lots of unexpected volatility with the most importan

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Since the supply of homes for sale is growing and mortgage rates are coming down, you may be thinking it’s finally your moment to jump into the market. To make sure you’re ready, you need to get pre-approved for a mortgage.

That’s

Reasons To Move in Today’s Shifting Market

You have 3 key opportunities if you’re looking to move this fall. Inventory is growing, homebuilders are motivated to sell, and mortgage rates have come down from their recent peak. Let’s connect if you want more information.

Kushner Breaks Ground on Controversial Colts Neck Project

Kushner Breaks Ground on Controversial Colts Neck Project

COLTS NECK – Kushner Companies broke ground on its 360-unit residential rental community, Livana Square, previously Colts Neck Manor, after winning a critical state permit that held up the development’s progress for years.

The groundbreaking

Rates Plummet as The Market Buys Into The Big Shift

30YR Fixed

6.40%

-0.22%

15YR Fixed

5.89%

-0.26%

Rates Plummet as The Market Buys Into The Big Shift

The events of this past week serve as an exclamation point in one of the many sentences that tells the story of the big shift

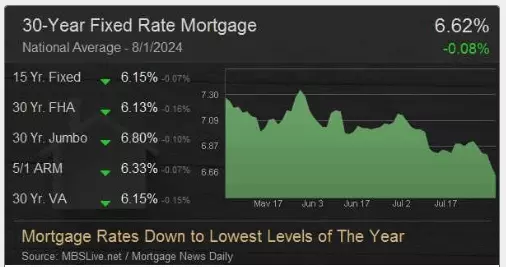

Mortgage Rates Down to Lowest Levels of The Year

30YR Fixed

6.40%

-0.22%

15YR Fixed

5.89%

-0.26%

Mortgage Rates Down to Lowest Levels of The Year

It's official! At this point, you'd need to go all the way back to the end of December 2023 to see a lower average rate for a top-tier, conve

Fed Rate Cuts Remain Elusive.

Why Markets Can’t Count on Inflation Data for Insight and 5 Other Things to Know Today.

Traders are still in the dark about when the Federal Reserve might start cutting interest rates. Even two new inflation data points this week may not provide much more clarity.

The producer price index is out T

Legends Tower: The Tallest Skyscraper in the US

Plans to build the country's tallest skyscraper in the heart of Oklahoma City have attracted national and international attention. But not all the publicity has been positive.

The 1,907-foot tall Legends Tower, proposed by developer Scot Matteson, would be part of the Boardwalk at Bricktown projec

SCOTUS Rules in Favor of Owners in Property Fee Dispute

The U.S. Supreme Court ruled unanimously on Friday that the government cannot demand hefty development fees from property owners in exchange for building permits. The case is being hailed by the National Association of REALTORS®, and other housing groups, as a major victory for property rights in

Construction Begins on Waterfront Residential Project in Atlantic Highlands

Brant Point Construction Begins

Denholtz Properties has broken ground on a collection of 16 luxury homes in Atlantic Highlands, seeking to lure buyers with what it describes as Nantucket-style living along Sandy Hook Bay.

Known as Brant Point, the custom-designed, single-family dwellings will occu

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265