New Jersey Real Estate Market Update: Trends in Long Branch, Monmouth County, & National Construction Insights

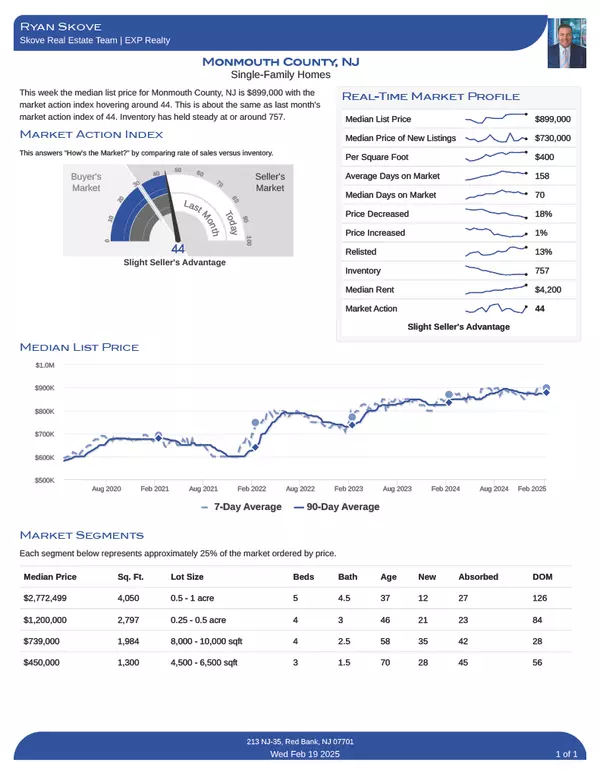

New Jersey Real Estate Market Update: Trends in Long Branch, Monmouth County, and National Construction Insights The real estate landscape is evolving rapidly, and staying informed is essential whether you're a seller, buyer, or investor. In this blog post, we explore the latest market updates for N

Refi Demand at 3 Month High Thanks to Lower Rates

Refi Demand at 3 Month High Thanks to Lower Rates Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.03% +0.01% 15YR Fixed 6.45% -0.01% Refi Demand at 3 Month High Thanks to Lower Rates In this week's update on mortgage applications from the Mortgage Bankers Asso

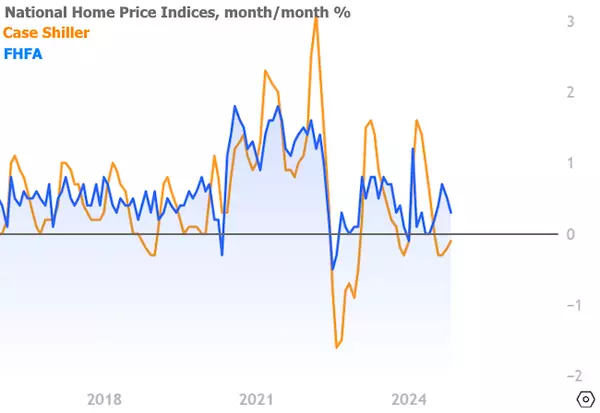

Home Price Appreciation Ran Just Above Expectations in November

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.07% +0.00% 15YR Fixed 6.49% +0.01% Home Price Appreciation Ran Just Above Expectations in November Both S&P Case-Shiller and the FHFA released national home price indices this morning. In both cases, November's pri

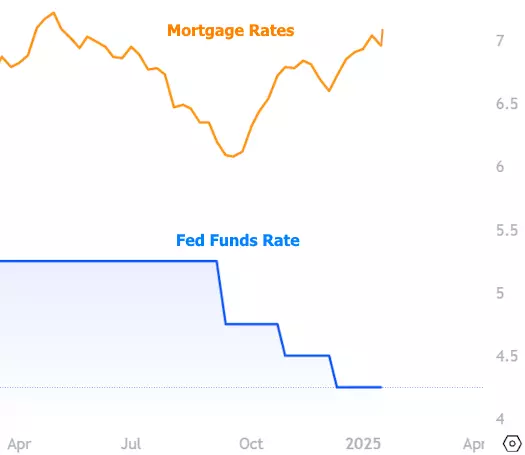

Can Trump Actually Force Rates to Move Lower?

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.07% -0.04% 15YR Fixed 6.48% -0.03% Can Trump Actually Force Rates to Move Lower? It turned out to be an intensely boring week for mortgage rates. The average lender stayed right in line with last week until moving

Existing Home Sales Inch Up to Highest Levels Since February

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.11% -0.01% 15YR Fixed 6.51% -0.01% Existing Home Sales Inch Up to Highest Levels Since February It's no mystery that 2024 hasn't been a stellar year for home sales and many other housing metrics. Today's releas

Highest Purchase Applications in a Year? Technically, Yes

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.11% -0.01% 15YR Fixed 6.51% -0.01% Highest Purchase Applications in a Year? Technically, Yes The Mortgage Bankers Association's (MBA) weekly mortgage application survey showed a modest decrease in refinance appli

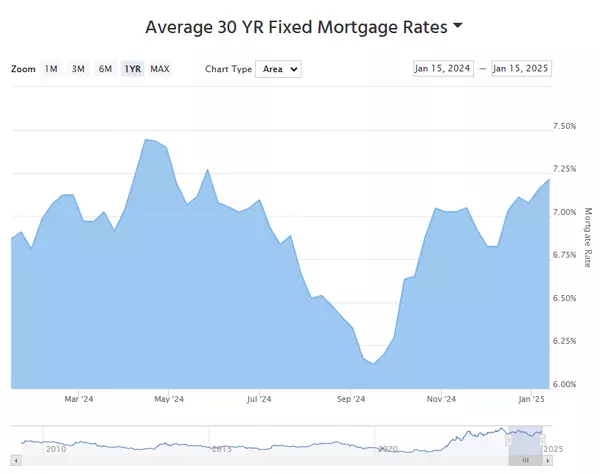

Mortgage Rate Watch - Jan 15th 2025

Ryan Skove has shared this article with you. Download PDF View on Web 30 YR Fixed 7.13% -0.12% 15 YR Fixed 6.52% -0.06% 30 YR FHA 6.55% -0.04% 30 YR Jumbo 7.40% -0.04% Mortgage Rates Make a Modest Recovery Ahead of Important Inflation Data Mortgage rates officially hit the highest levels s

Private equity firm Blackstone acquires Jersey Mike's sandwich chain for $8 billion

NEW JERSEY (NJRE.co) - Jersey Mike's, the quickly expanding sandwich chain, is being acquired by asset management giant Blackstone. In the transaction announced Tuesday, private equity funds managed by Blackstone will be used to acquire majority ownership of Jersey Mike's. The deal is "intended to h

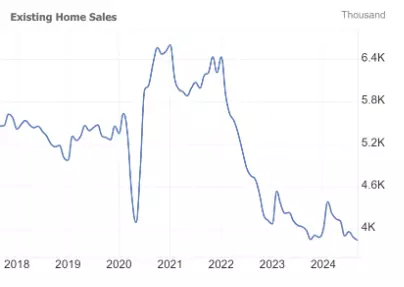

Existing Home Sales Update: Still Bad

30YR Fixed 7.09% +0.07% 15YR Fixed 6.48% -0.02% Existing Home Sales Update: Still Bad Housing was chugging right along in early 2020, then covid happened. Housing experienced lots of unexpected volatility with the most important development being a huge increase in demand and prices... at first

What is a Buyer Agency Agreement?

CONSUMER GUIDE: WHY AM I BEING ASKED TO SIGN A WRITTEN BUYER AGREEMENT? If you’re a homebuyer working with an agent who is a REALTOR®, it means you are working with a professional ethically obligated to work in your best interest. As of August 17, 2024, you will be asked to sign a written buyer agre

My Commitment to our Clients - Please Read

CONSUMER GUIDE: REALTORS’® DUTY TO PUT CLIENT INTERESTS ABOVE THEIR OWN A REALTOR® is a special kind of real estate agent: one who follows NAR’s strict Code of Ethics, including the first and primary pledge to protect and promote the interests of their clients. This obligation means that a REALTOR

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List Since the supply of homes for sale is growing and mortgage rates are coming down, you may be thinking it’s finally your moment to jump into the market. To make sure you’re ready, you need to get pre-approved for a mortgage. That’s w

Reasons To Move in Today’s Shifting Market

You have 3 key opportunities if you’re looking to move this fall. Inventory is growing, homebuilders are motivated to sell, and mortgage rates have come down from their recent peak. Let’s connect if you want more information.

Kushner Breaks Ground on Controversial Colts Neck Project

Kushner Breaks Ground on Controversial Colts Neck Project COLTS NECK – Kushner Companies broke ground on its 360-unit residential rental community, Livana Square, previously Colts Neck Manor, after winning a critical state permit that held up the development’s progress for years. The groundbreaking

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265