Builder Confidence at Best Levels in Ten Years

30YR Fixed 6.75% +0.13% 15YR Fixed 5.95% +0.09% Builder Confidence at Best Levels in Ten Years The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) shot higher in February, achieving a second monthly gain. NAHB’s chief economist Robert Dietz said the 7-point incr

Experts Can Help Close the Gap in Today’s Homeownership Rate

How Experts Can Help Close the Gap in Today’s Homeownership Rate As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeowne

This Spring: The Top Reasons for Selling Your House

The Top Reasons for Selling Your House Caption Many of today’s homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting to lose the low mortg

Home Prices Are Slightly Lower, But Far From Plummeting

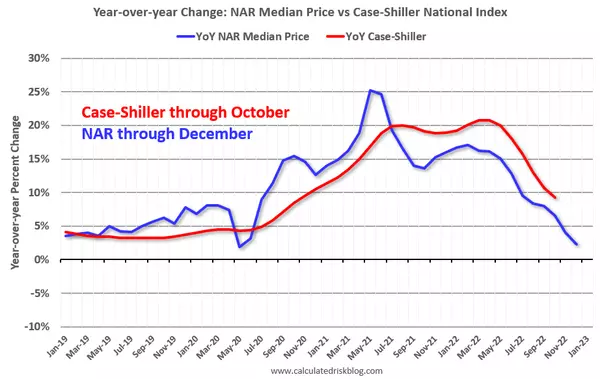

30YR Fixed 6.16% -0.01% 15YR Fixed 5.23% -0.01% Home Prices Are Slightly Lower, But Far From Plummeting As rates spiked and sales contracted at the fastest pace in decades last year, we knew the post-pandemic surge in home prices was set to reverse. By the middle of 2022, the average forecast saw

Lower Mortgage Rates Are Bringing Buyers Back to the Market

Lower Mortgage Rates Are Bringing Buyers Back to the Market As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling. Now, however, ra

New Home Sales Look Like They Want to Bounce

New Home Sales Look Like They Want to Bounce The Census Bureau's regularly scheduled monthly report on New Home Sales was released this morning. The annual pace of 616k was right in line with the median forecast of 617k. This is technically an improvement, but only because the previous month was r

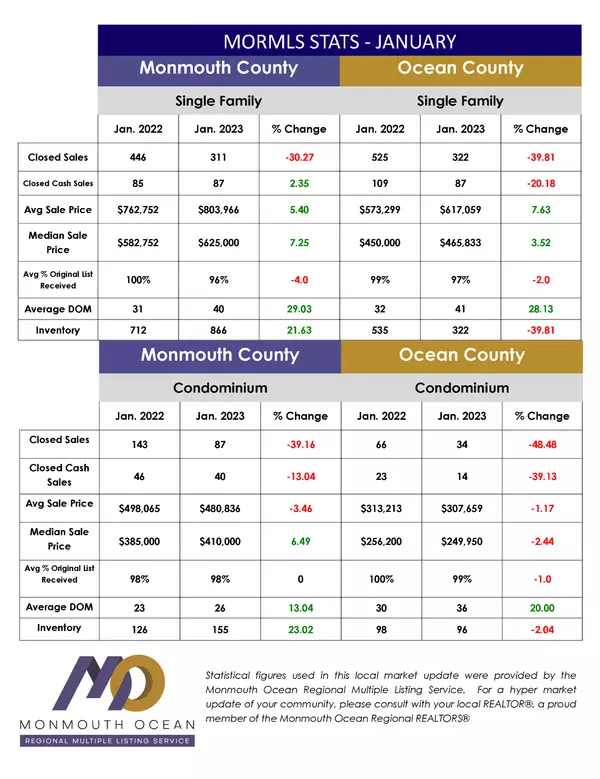

At The Shore, It Can Make Sense To Move Before Spring

Spring is usually the busiest season in the New Jersey and Monmouth County housing market. Many buyers wait until then to make their move, believing it’s the best time to find a home. However, that isn’t always the case when you factor in the competition you could face with other buyers at that ti

Rates May be Falling, But Other Mortgage Costs Are Going Up

Rates May be Falling, But Other Mortgage Costs Are Going Up Mortgage rates have fallen quite a bit since hitting a long term peak in late October. By the middle of this week, the average 30yr fixed rate was more than 1.25% lower from the highs and at the best levels in more than 4 months. Rates ha

Existing Home Sales Shrink for 11th Month

30YR Fixed 6.11% +0.07% 15YR Fixed 5.15% +0.03% Existing Home Sales Shrink for 11th Month Existing home sales fell back for the 11th straight month in December according to the National Association of Realtors® (NAR) The month’s sales of pre-owned single-family houses, townhouses, condominiums, an

Have Home Values Hit Bottom?

Have Home Values Hit Bottom? Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns about a repeat of what happened to p

Builders See a Turn-Around in Housing Starts on the Horizon

30YR Fixed 6.04% -0.13% 15YR Fixed 5.12% -0.16% Builders See a Turn-Around in Housing Starts on the Horizon On top of the solid report on mortgage volume earlier today, comes another hopeful report from the construction industry. The National Association of Home Builders (NAHB) says builder confid

Lower Inflation Portends Further Slide in Mortgage Rates

A dip below 6% has become a distinct possibility, says NAR Chief Economist Lawrence Yun. Inflation has been dropping over the past six months, and consumers can expect mortgage rates to soon follow, says Lawrence Yun, chief economist for the National Association of REALTORS®. The 30-year fixed-rat

Waiting for 3% Mortgage Rates? You Might Want To Think Twice

Last year, the Federal Reserve took action to try to bring down inflation. In response to those efforts, mortgage rates jumped up rapidly from the record lows we saw in 2021, peaking at just over 7% last October. Hopeful buyers experienced a hit to their purchasing power as a result, and some decide

If Rates Are at 4-Month Lows, Why Does The Fed Say They're Going Higher?

30YR Fixed 6.09% +0.02% 15YR Fixed 5.27% +0.02% If Rates Are at 4-Month Lows, Why Does The Fed Say They're Going Higher? Mortgage rates officially hit their lowest levels in 4 months after this week's inflation data. Despite the recent progress, Fed officials continue to talk about keeping rates h

Lowest Rates in 4 Months After Inflation Data

30YR Fixed 6.07% -0.08% 15YR Fixed 5.25% -0.12% Lowest Rates in 4 Months After Inflation Data Today brought the scheduled monthly release of the Consumer Price Index (CPI). Of all the monthly economic reports, this one has had the biggest impact on the bond market and mortgage rates for roughly a

Refinance Volume Reflects Lower Rates

30YR Fixed 6.07% -0.08% 15YR Fixed 5.25% -0.12% Refinance Volume Reflects Lower Rates Overall mortgage application activity returned to pre-holiday levels during the first week of the new year. Lower interest rates bolstered refinancing and the Mortgage Bankers Association said its Market Composit

Housing Market Is Nothing Like 15 Years Ago

Today’s Housing Market Is Nothing Like 15 Years Ago There’s no doubt today’s housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008 housing

Will Remote Work Continue in 2023?

With recession worries growing, power may shift back to employers and threaten perks gained during the pandemic. If the US job market continues to weaken next year, companies will be emboldened and may pull back on letting employees work remotely. Executives generally fall into two camps on working

"No One" Buying or Selling Existing Homes

30YR Fixed 6.32% +0.04% 15YR Fixed 5.57% +0.02% "No One" Buying or Selling Existing Homes "No one" is a relative term when it comes to economic data. There are actually about 4 million people per year buying existing homes based on the annualized and seasonally adjusted pace in the latest install

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265