Tariffs could drive up new home prices by as much as $22,000, research finds

On Tuesday, President Donald Trump’s administration imposed new tariffs on imports from Canada and Mexico while increasing existing tariffs on goods from China, a move expected to raise prices for new homes, according to a recent CoreLogic report.

That’s largely because tariffs affect essential hom

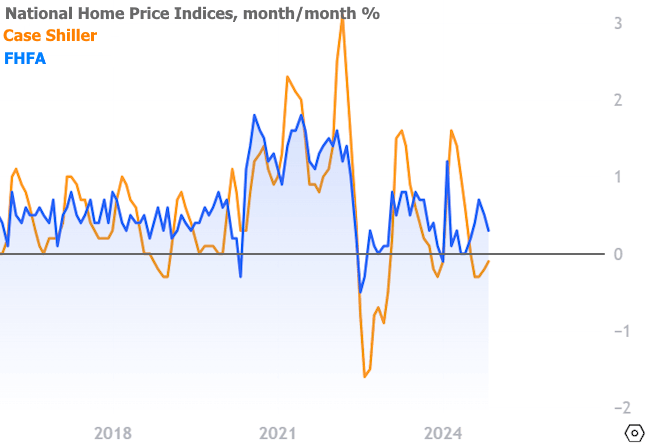

Home Price Appreciation Ran Just Above Expectations in November

Ryan Skove has shared this article with you. View | Download

30YR Fixed

7.07%

+0.00%

15YR Fixed

6.49%

+0.01%

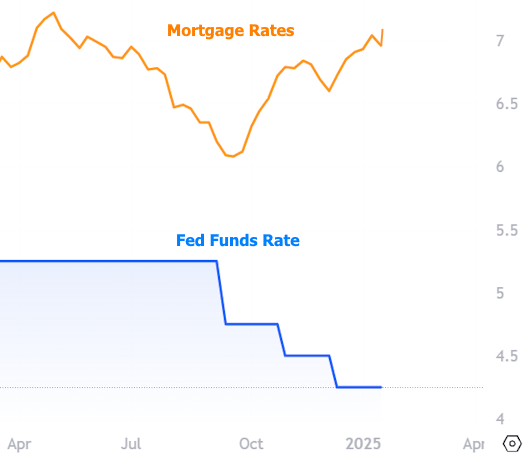

Can Trump Actually Force Rates to Move Lower?

Ryan Skove has shared this article with you. View | Download

30YR Fixed

7.07%

-0.04%

15YR Fixed

6.48%

-0.03%

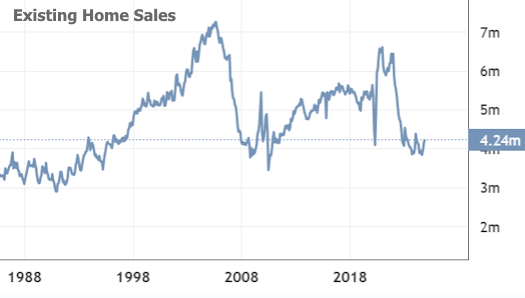

Existing Home Sales Inch Up to Highest Levels Since February

Ryan Skove has shared this article with you. View | Download

30YR Fixed

7.11%

-0.01%

15YR Fixed

6.51%

-0.01%

What is a Buyer Agency Agreement?

CONSUMER GUIDE:

WHY AM I BEING ASKED TO SIGN A WRITTEN BUYER AGREEMENT?

If you’re a homebuyer working with an agent who is a REALTOR®, it means you are working with a professional ethically obligated to work in your best interest. As of August 17, 2024, you will be asked to sign a written buyer agr

My Commitment to our Clients - Please Read

CONSUMER GUIDE:

REALTORS’® DUTY TO PUT CLIENT INTERESTS ABOVE THEIR OWN

A REALTOR® is a special kind of real estate agent: one who follows NAR’s strict Code of Ethics, including the first and primary pledge to protect and promote the interests of their clients.

This obligation means that a REALTO

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

Since the supply of homes for sale is growing and mortgage rates are coming down, you may be thinking it’s finally your moment to jump into the market. To make sure you’re ready, you need to get pre-approved for a mortgage.

That’s

Reasons To Move in Today’s Shifting Market

You have 3 key opportunities if you’re looking to move this fall. Inventory is growing, homebuilders are motivated to sell, and mortgage rates have come down from their recent peak. Let’s connect if you want more information.

Rates Plummet as The Market Buys Into The Big Shift

30YR Fixed

6.40%

-0.22%

15YR Fixed

5.89%

-0.26%

Rates Plummet as The Market Buys Into The Big Shift

The events of this past week serve as an exclamation point in one of the many sentences that tells the story of the big shift

Fed Rate Cuts Remain Elusive.

Why Markets Can’t Count on Inflation Data for Insight and 5 Other Things to Know Today.

Traders are still in the dark about when the Federal Reserve might start cutting interest rates. Even two new inflation data points this week may not provide much more clarity.

The producer price index is out T

Little Change in Mortgage Application Volume, Despite Lower Rates

30YR Fixed

6.91%

+0.00%

15YR Fixed

6.47%

+0.00%

Little Change in Mortgage Application Volume, Despite Lower Rates

The Mortgage Bankers Association said its Market Composite Index moved lower last week, apparently indifferent to a slight im

New Home Sales Decline Slightly, Prices Too

30YR Fixed

6.91%

+0.00%

15YR Fixed

6.47%

+0.00%

New Home Sales Decline Slightly, Prices Too

Sales of newly constructed homes were virtually unchanged in February. The 662,000 seasonally adjusted annual units recorded in during the

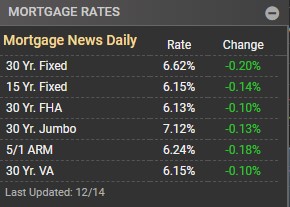

Rates Plummet to Lowest Levels Since May, 2023 After Fed Announcement

30YR Fixed

6.62%

-0.20%

15YR Fixed

6.15%

-0.14%

Rates Plummet to Lowest Levels Since May, 2023 After Fed Announcement

Today brought the scheduled Fed policy announcement that we've been waiting for and mortgage rates plummeted as a result

From 8% to Under 7.5%, Mortgage Rates Near-Record Week

30YR Fixed

7.51%

-0.18%

15YR Fixed

7.05%

-0.05%

From 8% to Under 7.5%, Mortgage Rates Had a Near-Record Week

The average top tier 30yr fixed mortgage rate was over 8% as recently as October 19th. At the start of the present week, things w

Your Home Equity Can Offset Affordability Challenges

Your Home Equity Can Offset Affordability Challenges

Are you thinking about selling your house? If so, today’s mortgage rates may be making you wonder if that’s the right decision. Some homeowners are reluctant to sell and take on a higher mortgage rate on their next home. If you’re worried about

Are More Homes Coming onto the Market?

Are More Homes Coming onto the Market?

An important factor shaping today’s market is the number of homes for sale. And, if you’re considering whether or not to list your house, that’s one of the biggest advantages you have right now. When housing inventory is this low, your house will stand out, e

Why Is Housing Inventory So Low?

Why Is Housing Inventory So Low?

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.

There aren’t enoug

Buyer Traffic Is Still Stronger than the Norm

Buyer Traffic Is Still Stronger than the Norm

Are you putting off selling your house because you’re worried no one’s buying because of where mortgage rates are? If so, know this: the latest data shows plenty of buyers are still out there, and they’re purchasing homes today. Here’s the data to prove

People Are Moving, But Where & Why?

Where Are People Moving Today and Why?

Plenty of people are still moving these days. And if you’re thinking of making a move yourself, you may be considering the inventory and affordability challenges in the housing market and wondering what you can do to help offset those. A new report from Gravy

The Value of an Agent When Buying Your New Construction Home

The Value of an Agent When Buying Your New Construction Home

Buying a new construction home can be an exciting experience. From being the very first owner, to customizing your home’s features, there are a lot of benefits. But navigating the complexities of buying a home that’s under construction ca

Ryan Skove

Phone:+1(732) 222-6336