The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view homeownership as a key life achievement. Let’s explore just a few of the reasons why so many Americans continue t

Key Factors Affecting Home Affordability Today

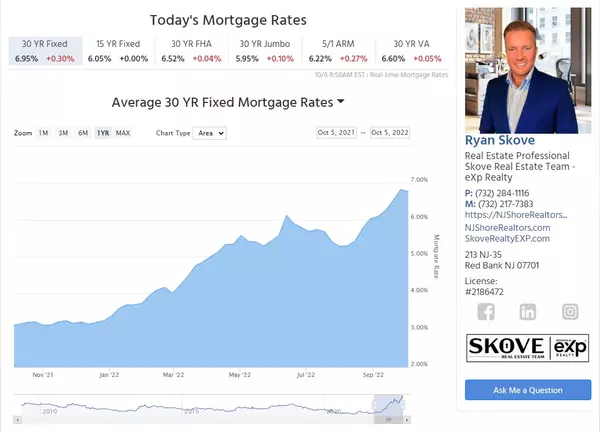

Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s true rates have risen dramatically, it’s important to remember they aren’t the

Millennials Are Still a Driving Force of Today’s Buyer Demand

If you’re thinking about selling your house but wondering if buyers are still out there, know that there are still people who are searching for a home to buy today. And your house may be exactly what they’re looking for. While the millennial generation has been dubbed the renter generation, that nam

Fannie, Freddie ordered to slash fees for many first-time homebuyers

Regulators order mortgage giants to eliminate upfront fees on many purchase loans in order to help first-time homebuyers of limited means, the Federal Housing Finance Agency said Monday Fannie Mae and Freddie Mac’s federal regulator is ordering the mortgage giants to eliminate upfront fees on many p

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008

3 Graphs Showing Why Today’s Housing Market Isn’t Like 2008 With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place

Home prices cooled at a record pace in August, S&P Case-Shiller says

Summary Home prices are still higher than they were a year ago, but gains are shrinking at the fastest pace on record, according to S&P Case-Shiller. Prices in August were 13% higher nationally compared with August 2021. That is down from a 15.6% annual gain in the previous month. Home prices are st

Mortgage Pre-Approval Is a Critical First Step on Your Homebuying Journey

If you’re planning to buy a home this year, one of the first steps on your journey is getting pre-approved. Especially in today’s market when mortgage rates are higher than they were just a few months ago, getting a mortgage pre-approval can be a game changer. Here’s why. What Is Pre-Approval? To be

Should You Still Buy a Home w/ the Latest News About Inflation?

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession. You’re likely feeling the impact in your day-to-day life

NJ Housing Market: Perspective Matters When Selling Your House Today

Perspective Matters When Selling Your House Today Does the latest news about the housing market have you questioning your plans to sell your house? If so, perspective is key. Here are some of the ways a trusted real estate professional can explain the shift that’s happening today and why it’s still

Mortgage Credit Availability Down to New 9yr Low

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.14% +0.02% 15YR Fixed 6.37% +0.02% Mortgage Credit Availability Down to New 9 Year Low in September The Mortgage Bankers Association (MBA) released its Mortgage Credit Availability Index (MCAI) for the month of Sep

Rates Back to 20 Year Highs as Economy Remains Resilient

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.12% +0.08% 15YR Fixed 6.35% +0.20% Rates Back to 20 Year Highs as Economy Remains Resilient The resilience of the economy is a matter of debate with different cases to be made depending on the data. But when it com

Mortgage Application Volume Plunges to 25 Year Low

Ryan Skove has shared this article with you. View | Download 30YR Fixed 7.04% +0.09% 15YR Fixed 6.15% +0.10% Application Volume Plunges to 25 Year Low There were two storms brewing last week and each contributed to driving mortgage applications to generational lows. The Mortgage Bankers

Mortgage Rates Jump Back Up Toward 7%

Mortgage Rates Jump Back Up Toward 7% Wed, Oct 5 2022, 4:19 PM The mortgage rate world has been on a wild ride in general, and even more so in the past few weeks. The crux of the drama was a British fiscal policy announcement that sent financial markets into a tailspin just after the September 21st

The Cost of Waiting for Mortgage Rates To Go Down

Mortgage rates have increased significantly in recent weeks. And that may mean you have questions about what this means for you if you’re planning to buy a home. Here’s some information that can help you make an informed decision when you set your homebuying plans. The Impact of Rising Mortgage Rate

How an Expert Can Help You Understand Inflation & Mortgage Rates

If you’re following today’s housing market, you know two of the top issues consumers face are inflation and mortgage rates. Let’s take a look at each one. Inflation and the Housing Market This year, inflation reached a high not seen in forty years. For the average consumer, you probably felt the pin

What Experts Say Will Happen with Home Prices Next Year

Experts are starting to make their 2023 home price forecasts. As they do, most agree homes will continue to gain value, just at a slower pace. Over the past couple of years, home prices have risen at an unsustainable rate, leaving many to wonder how long it would last. If you’re asking yourself: w

August 2022 Monthly Housing Market Trends Report

The national inventory of active listings increased by 26.6% over last year. The total inventory of unsold homes, including pending listings, increased by just 1.3% year-over-year due to a decline in pending inventory (-21.9%). Selling sentiment declined and listing activity followed, with newly l

Buyers Are Regaining Some of Their Negotiation Power

If you're thinking about buying a home today, there's welcome news. Even though it’s still a sellers’ market, it’s a more moderate sellers’ market than last year. And the days of feeling like you may need to waive contingencies or pay drastically over asking price to get your offer considered may be

Mortgage App Volume Declines, But Jobs Data Offers Silver Lining

The Mortgage Bankers Association (MBA)says the pace of mortgage applications slowed fora fourth consecutive time during the week ended September 2. MBA’sseasonally adjustedMarket Composite Index, a measure of application volume, decreased 0.8 percent headinginto the long Labor Day holiday weekend. O

Expert Forecasts on Mortgage Rates %

Expert Forecasts on Mortgage Rates If you’ve been thinking of buying a home, you may have been watching what’s happened with mortgage rates over the past year. It’s true they’ve risen dramatically, but where will they go from here, especially as the market continues to slow? As you think about your

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265