Mortgage Application Volume Increases Despite Higher Rates

Mortgage application volume increased during the week ending April 21. The Mortgage Bankers Association (MBA) said its Market Composite Index, a measure of that volume, rose 3.7 percent on a seasonally adjusted basis compared to the prior week and was 5 percent higher before adjustment. The Refinanc

Is There Really a New, Unfair Mortgage Tax on Those With High Credit?

30YR Fixed 6.66% -0.01% 15YR Fixed 6.04% -0.01% Is There Really a New, Unfair Mortgage Tax on Those With High Credit? Seemingly overnight, the internet is awash with news regarding a "new," unfair tax on mortgage borrowers with higher credit scores. Some have gone so far as to suggest that someone

Existing Home Sales Hit by Higher Rates and Low Inventory

30YR Fixed 6.66% -0.01% 15YR Fixed 6.04% -0.01% Existing Home Sales Hit by Higher Rates and Low Inventory The National Association of Realtors (NAR) measures the sales of previously owned homes. These so-called Existing Home Sales account for a vast majority of all home sales in the US. Existin

Rates Having a Tough Time Turning The Corner

30YR Fixed 6.67% -0.08% 15YR Fixed 6.05% -0.07% Rates Having a Tough Time Turning The Corner The good news is that last November increasingly looks like the moment when rates stopped surging higher at the fastest pace in 40 years. The not-so-good news is that they still don't seem sure what to do

Calmer Markets; Are Home Prices Already Done Falling?

30YR Fixed 6.57% -0.02% 15YR Fixed 5.99% -0.01% Calmer Markets; Are Home Prices Already Done Falling? The bond market moved far less over the entire week than it did during a single day last week. Not only was volatility much lighter, but the trading patterns changed as well. At the onset of the r

Failing Banks, Falling Rates, Falling Prices. Should You Worry?

30YR Fixed 6.59% -0.02% 15YR Fixed 6.00% -0.02% Failing Banks, Falling Rates, Falling Prices. Should You Worry? While there were no further bank failures this week, there was plenty of concern and speculation about who might be next. Those concerns teamed up with Wednesday's Fed announcement to pu

Pending Home Sales Adding to Resilient Housing Narrative

30YR Fixed 6.61% +0.01% 15YR Fixed 6.02% +0.02% Pending Home Sales Adding to Resilient Housing Narrative January was a refreshingly strong month for many economic reports, but especially for metrics relating to the housing and mortgage markets. This wasn't too hard to reconcile with December and

New Home Sales Rose Slightly

30YR Fixed 6.44% -0.01% 15YR Fixed 5.93% -0.02% New Home Sales Rose Slightly After Revisions Erased January's Surge New home sales surprised everyone in January, surging by 7.5 percent to 670,000 units, the highest rate since March 2022. It was, however, only an illusion. That number has now been

Mortgage Application Volume Inches Higher as Rates Find Their Footing

30YR Fixed 6.70% -0.05% 15YR Fixed 6.12% -0.05% Mortgage Application Volume Inches Higher as Rates Find Their Footing A second week of declining interest rates prompted another increase in mortgage activity last week, the third in as many weeks. The Mortgage Bankers Association (MBA) said its Mark

US Home Resales Jump by Most Since 2020, Ending Year-Long Slide

February contract closings surged 14.5% to 4.58 million rate Annual decline in median sales price was first since 2012 US sales of previously owned homes rose in February by the most since mid-2020, snapping a record year-long slide tied to rising interest rates and affordability constraints. Cont

What Buyer Activity Tells Us About the Housing Market

Though the housing market is no longer experiencing the frenzy of a year ago, buyers are showing their interest in purchasing a home. According to U.S. News: “Housing markets have cooled slightly, but demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes o

Construction Stats Improve, Multifamily Plays Leading Role

30YR Fixed 6.54% -0.01% 15YR Fixed 5.98% -0.02% Construction Stats Improve, Multifamily Plays Leading Role It didn’t approach the levels of the “good old days” of 2020 and 2021, but construction activity did show signs of life last month. The U.S. Census Bureau and the Department of Housing and Ur

Credit Availability Hits Multi-Year Lows

30YR Fixed 6.75% +0.18% 15YR Fixed 6.22% +0.22% Harder for Borrowers to Secure a Loan in February, Credit Availability Hits Multi-Year Lows Mortgage credit availability fell to just short of its 2012 benchmark level in February. The Mortgage Bankers Association (MBA) said its Mortgage Credit Avail

Mortgage Application Volume Up Slightly, Despite Higher Rates

30YR Fixed 7.00% -0.05% 15YR Fixed 6.45% -0.05% Mortgage Application Volume Up Slightly, Despite Higher Rates Mortgage applications activity increased for the first time in three weeks during the period ending March 3, despite the slight increase in rate. The degree of that change is a little mud

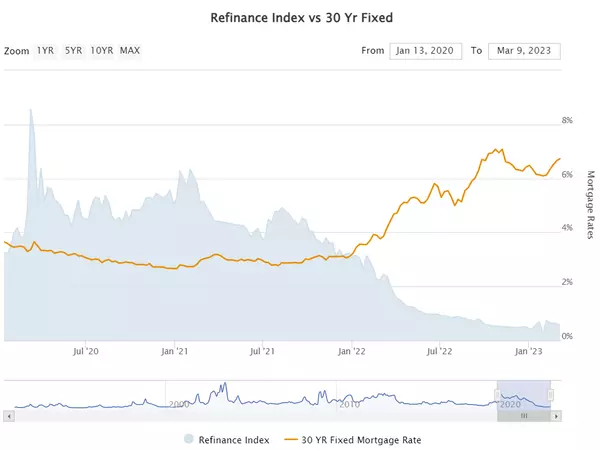

More Charts, Fewer Words

30YR Fixed 6.99% +0.02% 15YR Fixed 6.45% +0.02% More Charts, Fewer Words (Recapping This Month's Mortgage Monitor From Black Knight) Black Knight releases a robust collection of mortgage/housing info each month via its Mortgage Monitor report. There are always more charts than we have time and ro

HOME-SELLER PROFITS ROSE IN 2022, DESPITE MARKET SLOWDOWN

Home sellers across the US realised a profit of $112,000 on the typical sale in 2022, up 21% from $92,500 in 2021 and up 78% from $63,000 two years ago, according to a new report from ATTOM. ATTOM’s Year-End 2022 U.S. Home Sales Report found that despite a market slowdown in the second half of las

Equity Gains for Today’s Homeowners

Today’s homeowners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates. How Equity Has Grown in Recent

Home Prices Continued Moderate Pace of Correction in December

30YR Fixed 6.97% -0.13% 15YR Fixed 6.43% -0.07% Home Prices Continued Moderate Pace of Correction in December FHFA and S&P Case Shiller each released their monthly home price indices (HPIs) for December this morning. These are the two most widely followed HPIs. FHFA has a broader reach while Cas

What You Should Know About Rising Mortgage Rates

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may

New Construction Numbers Would Look Way Worse Without Multifamily

30YR Fixed 6.80% +0.02% 15YR Fixed 5.95% +0.01% New Construction Numbers Would Look Way Worse Without Multifamily It seems that most of the stories I write on home sales and construction numbers begin with a slightly different iteration of the same core thought: the housing market has undoubtedly

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265