Closing Costs! What You Should Know

What You Should Know About Closing Costs

Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your ho

Experts Can Help Close the Gap in Today’s Homeownership Rate

How Experts Can Help Close the Gap in Today’s Homeownership Rate

As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeow

The Top House-Hunting Mistakes We See

Caption

Buying a home is a very emotional process. If you allow those emotions to get the best of you, you may fall prey to several common home buyer mistakes. Since homeownership has far-reaching implications, it's important to keep your emotions in check and make the most rational decision

Home Prices Are Slightly Lower, But Far From Plummeting

30YR Fixed

6.16%

-0.01%

15YR Fixed

5.23%

-0.01%

Home Prices Are Slightly Lower, But Far From Plummeting

As rates spiked and sales contracted at the fastest pace in decades last year, we knew the post-pandemic surge in home prices

Lower Mortgage Rates Are Bringing Buyers Back to the Market

Lower Mortgage Rates Are Bringing Buyers Back to the Market

As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling.

Now, however,

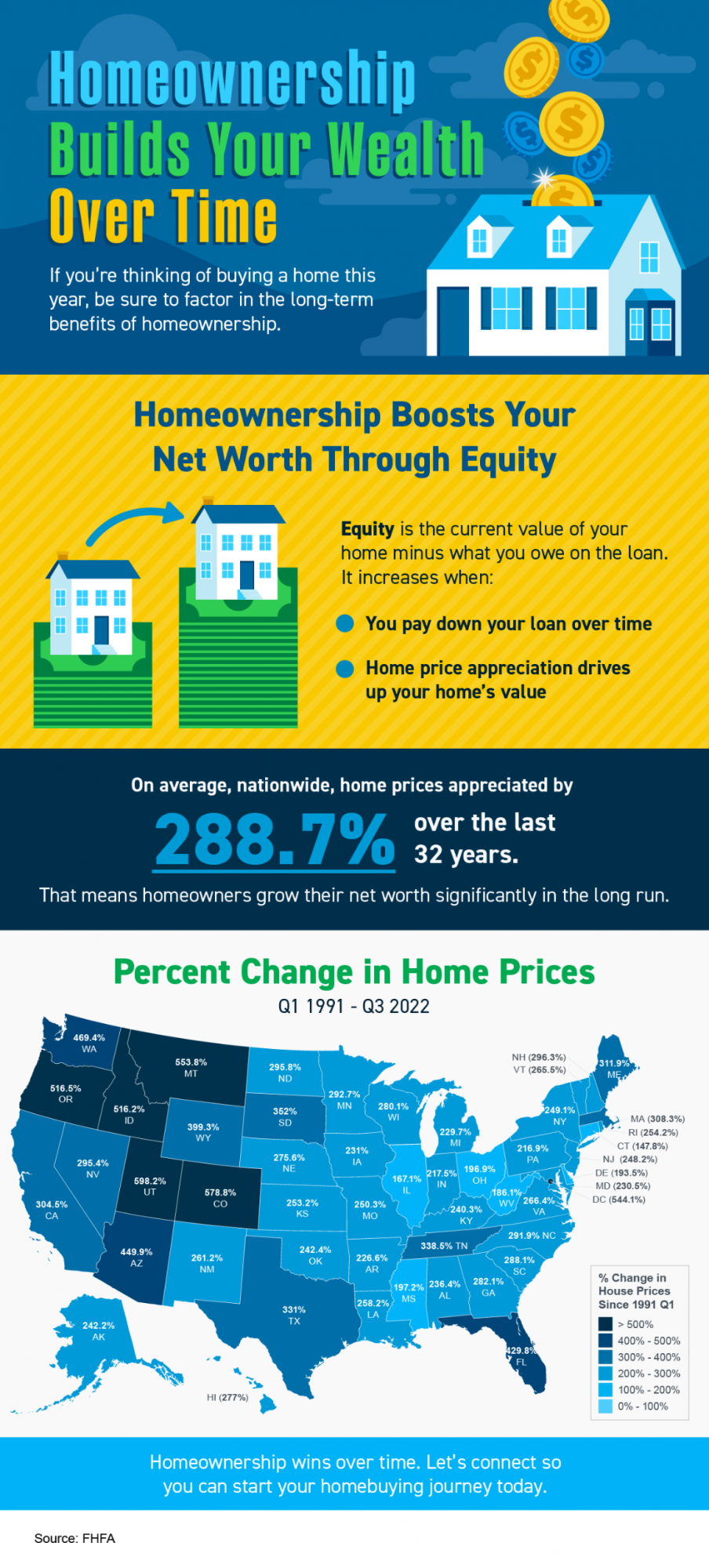

Homeownership Builds Your Wealth Over Time

Some Highlights

If you’re thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership.

On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term.

Homeownership win

Mortgage Pre-Approval in 2023: One Of The First Steps

Pre-Approval in 2023: What You Need To Know

One of the first steps in your homebuying journey is getting pre-approved. To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains:

“In a preapproval [sic], the lende

You May Have More Negotiation Power When You Buy a Home Today

Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper competitive market has cooled this year as buyer demand has moderated and housing supply has grown. Those two factors combined mean you may see less compe

What You Want To Know If You’re Pursuing Your Dream of Homeownership

If you’re a young adult, you may be thinking about your goals and priorities for the months and years ahead. And if homeownership ranks high on your goal sheet, you’re in good company. Many of your peers are also pursuing their dream of owning a home. The 2022 Millennial & Gen Z Borrower Sentiment

$726,200 is The New Loan Limit for 2023; Monmouth County Now Over $1m

30YR Fixed

6.29%

-0.34%

15YR Fixed

5.75%

-0.23%

$726,200 is The New Loan Limit for 2023; High Cost Counties Now Over $1m

If you're just here for the conforming loan limit news, $726,200 is the number for 2023.

Does this mea

Why There Won’t Be a Flood of Foreclosures Coming to the Housing Market

With the rapid shift that’s happened in the housing market this year, some people are raising concerns that we’re destined for a repeat of the crash we saw in 2008. But in truth, there are many key differences between what’s happening today and the bubble in the early 2000s.

One of the reasons thi

What Buyers Need To Know About the Inventory of Homes Available for Sale

⇒ If you’re thinking about buying a home, you’re likely trying to juggle your needs, current mortgage rates, home prices, your schedule, and more to try to decide if you want to jump into the market.

If this sounds like you, here’s one key factor that could help you with your decision: there are m

Mortgage Rates Will Come Down, It’s Just a Matter of Time

This past year, rising mortgage rates have slowed the red-hot housing market. Over the past nine months, we’ve seen fewer homes sold than the previous month as home price growth has slowed. All of this is due to the fact that the average 30-year fixed mortgage rate has doubled this year, severely

More People Are Finding the Benefits of Multigenerational Households Today

If you’re thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational

Mortgage Rates Roughly Unchanged After Last Week's Huge Drop

Ryan Skove has shared this article with you. View | Download

30YR Fixed

6.61%

-0.04%

15YR Fixed

6.05%

-0.07%

It May Be Time To Add Newly Built Homes to Your Search

If you put a pause on your home search because you weren’t sure where you’d go once you sold your house, it might be a good time to get back into the market. If you’re willing to work with a trusted agent to consider a newly built home, you may have even more options and incentives than you realiz

What’s Ahead for Mortgage Rates and Home Prices?

What’s Ahead for Mortgage Rates and Home Prices?

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates a

The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream. In fact, the 2022 Consumer Insights Report from Mynd found the majority of people polled still view homeownership as a key life achievement. Let’s explore just a few of the reasons why so many Americans continue

Key Factors Affecting Home Affordability Today

Every time there’s a news segment about the housing market, we hear about the affordability challenges buyers are facing today. Those headlines are focused on how much mortgage rates have climbed this year. And while it’s true rates have risen dramatically, it’s important to remember they aren’t t

3 Trends That Are Good News for Today’s Homebuyers

While higher mortgage rates are creating affordability challenges for homebuyers this year, there is some good news for those people still looking to buy a home.

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too. Here are j

Ryan Skove

Phone:+1(732) 222-6336