Construction Stats Improve, Multifamily Plays Leading Role

30YR Fixed 6.54% -0.01% 15YR Fixed 5.98% -0.02% Construction Stats Improve, Multifamily Plays Leading Role It didn’t approach the levels of the “good old days” of 2020 and 2021, but construction activity did show signs of life last month. The U.S. Census Bureau and the Department of Housing and Ur

Balancing Your Wants and Needs as a Homebuyer This Spring

Though there are more homes for sale now than there were at this time last year, there’s still an undersupply with fewer houses available than in more normal, pre-pandemic years. The Monthly Housing Market Trends Report from realtor.com puts it this way: “While the number of homes for sale is inc

Credit Availability Hits Multi-Year Lows

30YR Fixed 6.75% +0.18% 15YR Fixed 6.22% +0.22% Harder for Borrowers to Secure a Loan in February, Credit Availability Hits Multi-Year Lows Mortgage credit availability fell to just short of its 2012 benchmark level in February. The Mortgage Bankers Association (MBA) said its Mortgage Credit Avail

Leverage Your Equity When You Sell Your House

One of the benefits of being a homeowner is that you build equity over time. By selling your house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like this: “Home equity

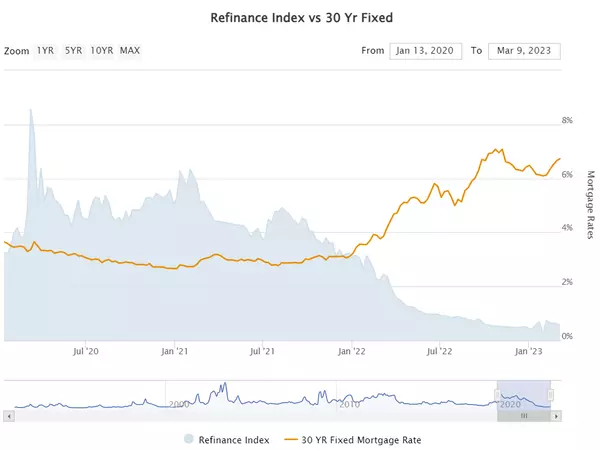

Mortgage Application Volume Up Slightly, Despite Higher Rates

30YR Fixed 7.00% -0.05% 15YR Fixed 6.45% -0.05% Mortgage Application Volume Up Slightly, Despite Higher Rates Mortgage applications activity increased for the first time in three weeks during the period ending March 3, despite the slight increase in rate. The degree of that change is a little mud

4 Tips for Making Your Best Offer on a Home

Are you planning to buy a home this spring? Though things are more balanced than they were at the height of the pandemic, it’s still a sellers’ market. So, when you find the home you want to buy, remember these four tips to make your best offer. 1.Lean on a Real Estate Professional Rely on an agent

2 Things Sellers Need To Know This Spring

A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market. If you’re planning to sell your house this season, here’s what real estate experts are saying you should keep in mind. 1. Houses That Are Priced Right Are Still Selling Houses that are upd

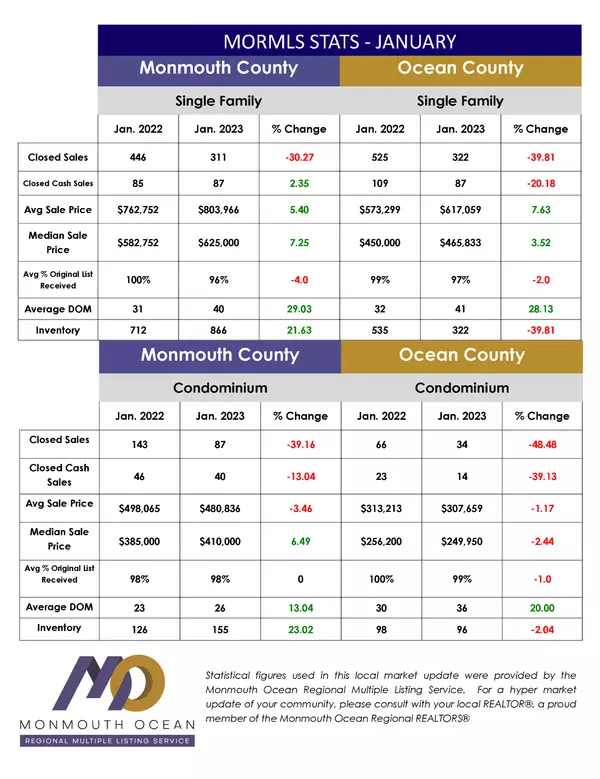

More Charts, Fewer Words

30YR Fixed 6.99% +0.02% 15YR Fixed 6.45% +0.02% More Charts, Fewer Words (Recapping This Month's Mortgage Monitor From Black Knight) Black Knight releases a robust collection of mortgage/housing info each month via its Mortgage Monitor report. There are always more charts than we have time and ro

HOME-SELLER PROFITS ROSE IN 2022, DESPITE MARKET SLOWDOWN

Home sellers across the US realised a profit of $112,000 on the typical sale in 2022, up 21% from $92,500 in 2021 and up 78% from $63,000 two years ago, according to a new report from ATTOM. ATTOM’s Year-End 2022 U.S. Home Sales Report found that despite a market slowdown in the second half of las

Is It Really Better To Rent Than To Own a Home Right Now?

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on. A lot of the time, these reports are assuming things that aren’t realistic for the ave

Equity Gains for Today’s Homeowners

Today’s homeowners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates. How Equity Has Grown in Recent

Home Prices Continued Moderate Pace of Correction in December

30YR Fixed 6.97% -0.13% 15YR Fixed 6.43% -0.07% Home Prices Continued Moderate Pace of Correction in December FHFA and S&P Case Shiller each released their monthly home price indices (HPIs) for December this morning. These are the two most widely followed HPIs. FHFA has a broader reach while Cas

What You Should Know About Rising Mortgage Rates

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may

New Construction Numbers Would Look Way Worse Without Multifamily

30YR Fixed 6.80% +0.02% 15YR Fixed 5.95% +0.01% New Construction Numbers Would Look Way Worse Without Multifamily It seems that most of the stories I write on home sales and construction numbers begin with a slightly different iteration of the same core thought: the housing market has undoubtedly

Builder Confidence at Best Levels in Ten Years

30YR Fixed 6.75% +0.13% 15YR Fixed 5.95% +0.09% Builder Confidence at Best Levels in Ten Years The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) shot higher in February, achieving a second monthly gain. NAHB’s chief economist Robert Dietz said the 7-point incr

Should You Consider Buying a Newly Built Home ?

If you’re thinking about buying a home, you might be focusing on previously owned ones. But with so few houses for sale today, it makes sense to consider all your options, and that includes a home that’s newly built. The Number of Newly Built Homes Is on the Rise While there are more houses for sale

Closing Costs! What You Should Know

What You Should Know About Closing Costs Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home

Top 5 Monmouth County Beaches

Top 5 Monmouth County Beaches Monmouth County is known for its breathtaking beaches and is a popular destination for beachgoers. Here are some of the best beaches in Monmouth County, NJ that you should consider visiting: 1. Seven Presidents Oceanfront Park: This park is named after the seven Unit

Experts Can Help Close the Gap in Today’s Homeownership Rate

How Experts Can Help Close the Gap in Today’s Homeownership Rate As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeowne

Ryan Skove, ABR, SRS

Phone:+1(732) 365-0265